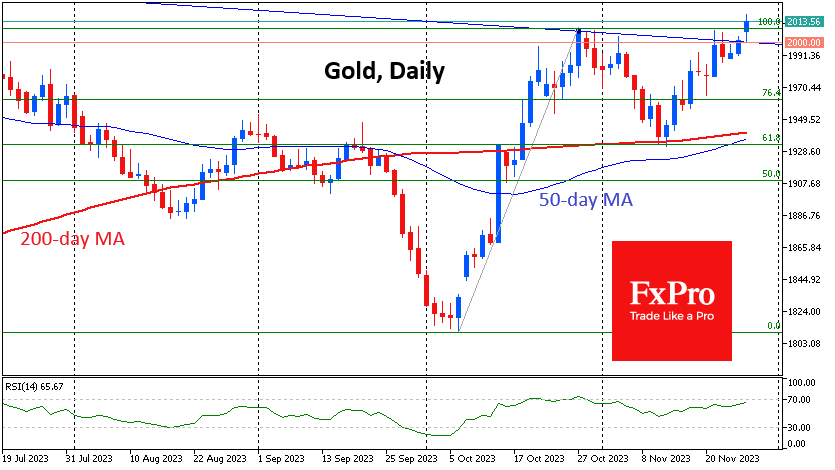

Gold touched six-month highs, moving into territory above $2010 at the start of the new week. Over the past three years, the price has climbed above $2000 several times but failed to hold there for a long.

Technically, gold started the week with a dash into thin air territory as the price went above the previous local highs soon after the opening bell. This is an immaculate execution of the Fibonacci pattern, where the initial momentum from $1810 to $2010 corrected to 61.8% of that move, which also coincided with a touch of the 200-day average at $1935. The breakout to new highs formally confirms a bullish scenario with a potential move to 161.8% at $2130.

Gold will need strong tailwinds to realise such a bullish scenario. And there could be problems with that. A robust US economy and a worrisome geopolitical environment have kept interest in gold alive, as has pressure in US debt markets. For investors, government bonds look more attractive than gold because they yield, and at one point, they were down 50% from their peak.

The interest in gold at high levels in recent years may also have been fuelled by the interest of China or other emerging markets to diversify their reserves away from the dollar. Whether this was actual demand or just speculation to that effect is not essential. The big question now is whether China or Saudi Arabia will remain net buyers of gold amid shrinking trade surpluses or move into active gold sales to support the growth of their economies.

The long-term picture also points to the formation of a triple top in gold – a reversal pattern. However, its legitimacy is now in doubt amid the rapid upward reversal since the beginning of October.

In any case, the dynamics of gold in the coming days promise to be trend-defining for many months ahead, as we may see either a breakout of long-term and psychologically important resistance or the beginning of a multi-month or even multi-year bear market.

The FxPro Analyst Team