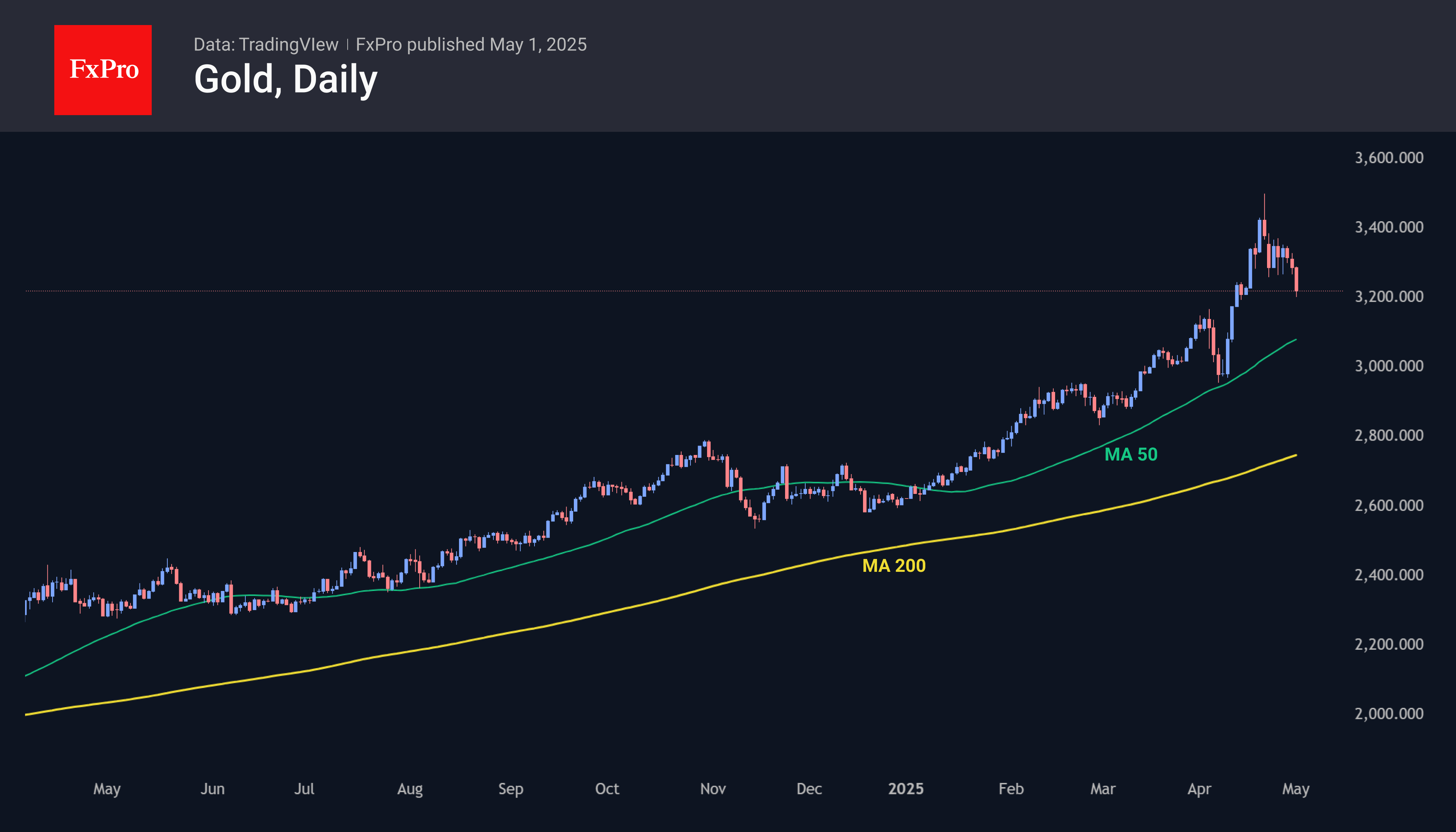

The pressure on gold intensified again at the end of the week. For the last several months, we have observed that consolidation in the first half of the week often follows a strong move in its second half.

The beginning of April was for the bulls, while the last couple of weeks were driven by the bears, who are testing the $3200 mark. This pullback has brought the price back to the mid-April consolidation area. If the market continues to move down the same steps, the next stop will be the area of $2900. In this case, however, the price will already be trading below the 50-day moving average, indicating a break in the uptrend. An acceleration of the sell-off could quickly take the price to consolidate to the $2600-$2700 area.

Silver is having a tough time with gold and the proximity of its own historical turning point. The price reversed downwards in 2012 and 2024 as it approached the $35/oz level. And between those dates, it was strongly lower. That is, strong internal resistance coincided with gold’s growth fatigue. However, the way silver was bought back after the failure in April makes one maintain a positive view not only on this metal but also on gold.

The FxPro Analyst Team