Gold reacts strongly to geopolitics and has reached another record high, rising for the fourth week in a row. Washington is ready to wage economic war on the Kremlin’s main allies, India and China, if Brussels supports it. As a result, there is an increased risk that central banks will step up their gold purchases as part of their reserve diversification and de-dollarisation processes.

Geopolitics has made the precious metal less sensitive to the Fed’s monetary policy. Even the resurgent US dollar has been unable to put a spoke in gold’s wheel. Neither could the White House’s announcement that it would exclude this asset from the list of potential tariffs.

If Donald Trump manages to drive a wedge between Russia, India, and China, oil prices will rise, and inflation will accelerate. A stagflationary environment and increased central bank purchases of bullion will help gold.

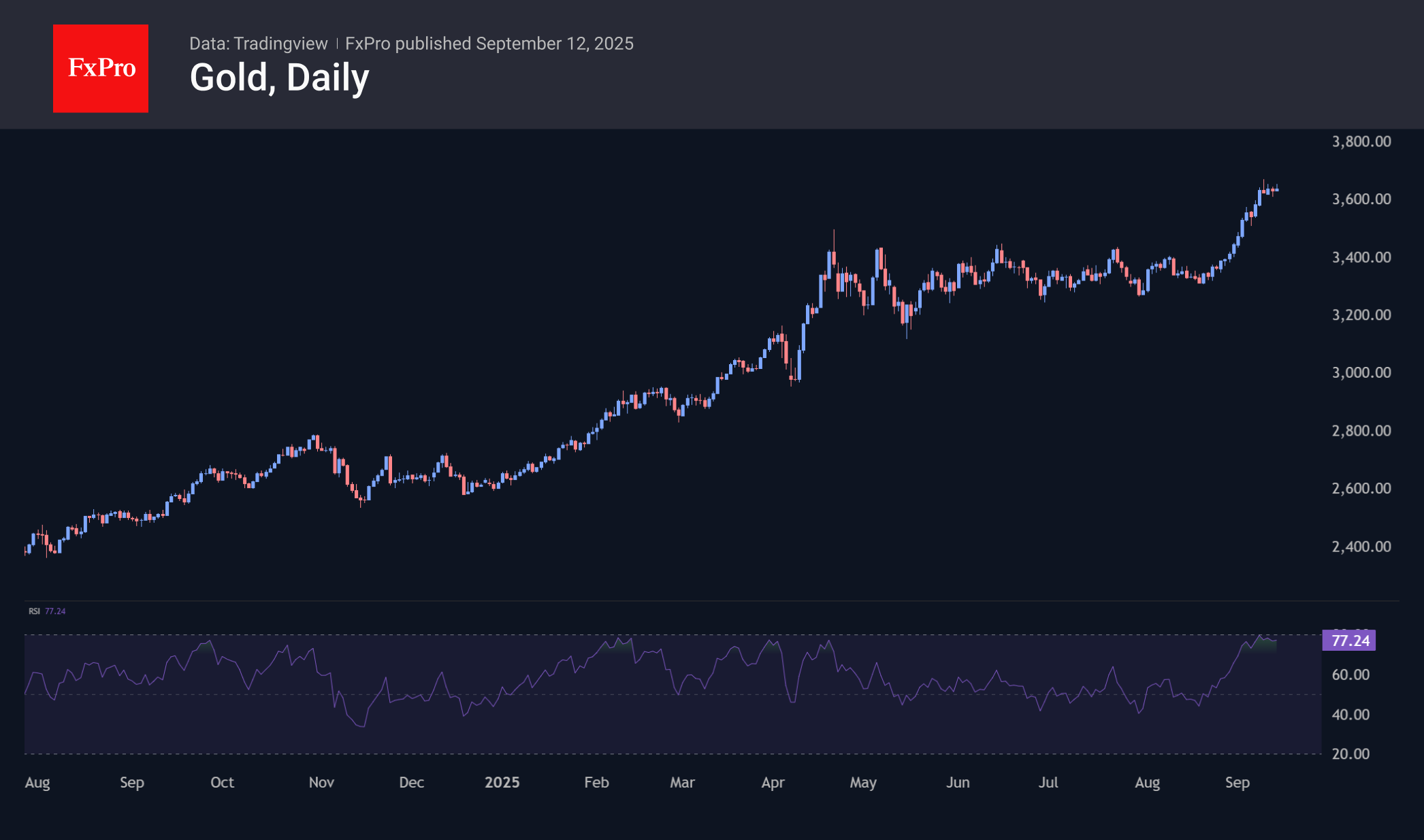

However, in the short term, we note technical overbought conditions after an impressive rise. This was reflected in the stabilisation of prices from Tuesday to Friday, contrary to the continued growth of silver and other precious metals and new highs in stock indices. In daily timeframes, the RSI gradually declines after touching the zone above 80. In 10 out of 11 cases over the past six years, such a signal has been followed by corrective pullbacks, which may well happen again this time.

The expected cut in the key rate on Wednesday risks triggering a “buy the rumours, sell the fact” pattern.

The FxPro Analyst Team