The insatiable appetite of central banks has resulted in an increase in the share of gold value in reserves to 20%. Precious metals have surpassed the euro’s 16% share. Only the US dollar is ahead with 46%. In 2022-2024, regulators increased their purchases to more than 1,000 tonnes annually. As a result, their combined gold reserves grew to 36,000 tonnes by the end of last year. They are now very close to the record set in 1965 of 38,000 tonnes.

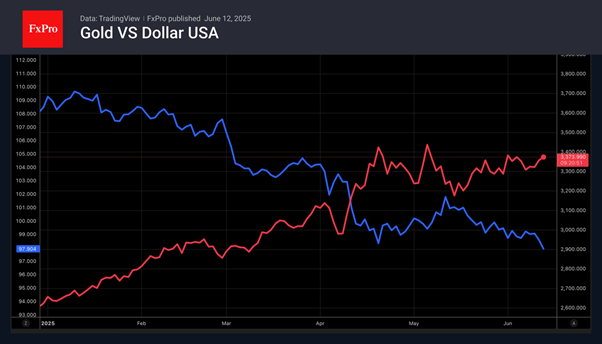

The weakening of the US dollar and falling Treasury yields support the gold price. The reluctance of US inflation to accelerate under the influence of tariffs and the cooling of the economy increases the risks of resuming the Fed’s monetary expansion cycle as early as September. Until recently, the futures market has not been pricing a rate cut until October.

Geopolitics is playing in favour of the precious metal. Gold is a safe-haven asset and proved with its performance last night. Demand for it is growing as the risks of a new conflict in the Middle East increase. The future fate of the precious metal will depend on the resistance test at $3,400 per ounce.

The FxPro Analyst Team