Gold returned to growth after nearly three weeks of decline, reversing last week’s drop. The desire for a safe haven for global capital is so strong that it far outweighs the effect of a stronger dollar. The growing tension around the Russia-Ukraine conflict has brought gold back into the focus of investors due to pressure in equity markets.

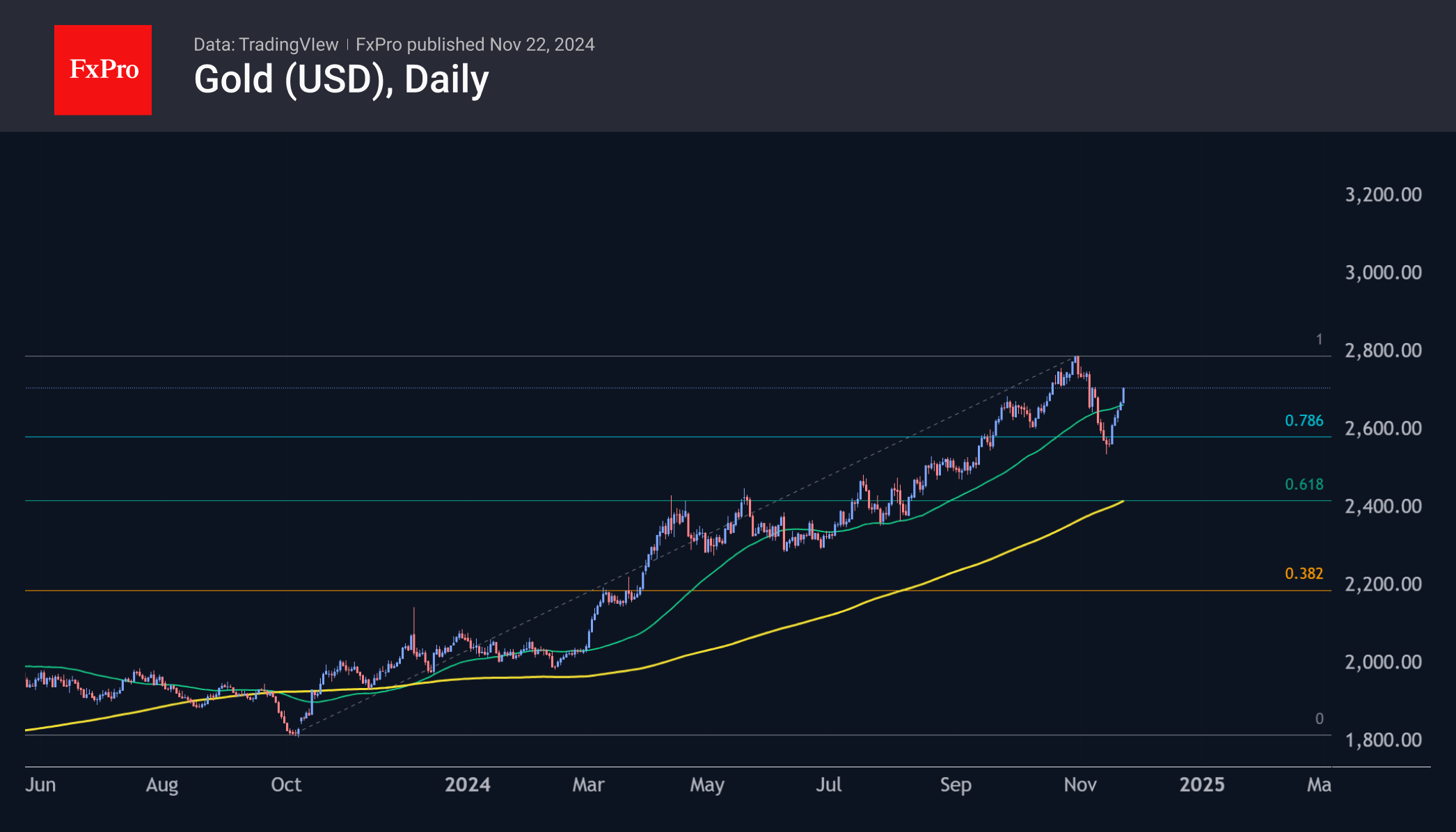

Since the beginning of the week, the price has gained 5.3%, returning above $2,700. Technically, the price found buyers again shortly after falling below the 50-day moving average, which acts as a significant indicator of the medium-term trend. The ability to rise further would be an important price signal.

A quick reversal from down to up makes the scenario workable. The decline in early November is a technical correction from October 2023’s rally, which ended with a decline to 76.4% of the total gain. Such shallow corrections are characteristic of strong markets. If gold manages to rewrite the highs soon, the long-term target will be the $3,400 per troy ounce area.

The weakness of the single currency, caused both by geopolitics and the sharp cooling of the economy and political crisis in Germany, is also a serious reason to move into gold.

The chart of the gold price in euro paints an even more technically beautiful picture. On Friday, gold surpassed the €2,600 per ounce mark, hitting an all-time high, adding every day this week. The turning point that attracted buyers was the touching of the 50-day moving average towards the end of last week. For more than a year, this curve has provided tactical support: localised selloffs stop there.

The drawdown at the beginning of the month also fits into a classic Fibonacci retracement, with a pullback to 61.8% of the rise from the August lows to the late October highs. Movement within this pattern suggests the next shakeout near €2,840, which could well be a bullish target. At the current exchange rate, this roughly puts the price at $3,000. Given the decline of the single currency, these could be lower levels as well.

The FxPro Analyst Team