The pressure on risk assets on 31 December and 2 January, including a 1.5% rise in the dollar over the period, has not prevented Gold from strengthening. Although the market amplitude is still rather unimpressive, a simultaneous rise in the dollar and gold as equities fall is characteristic of periods of safe-haven traction.

If these sentiments find a solid footing, we could see the dollar’s bullish momentum develop. Much depends on the trade war situation. The further distancing of production chains is a signal for global speculators to step up their gold buying in anticipation of China and other emerging markets favouring gold over dollar-denominated bonds.

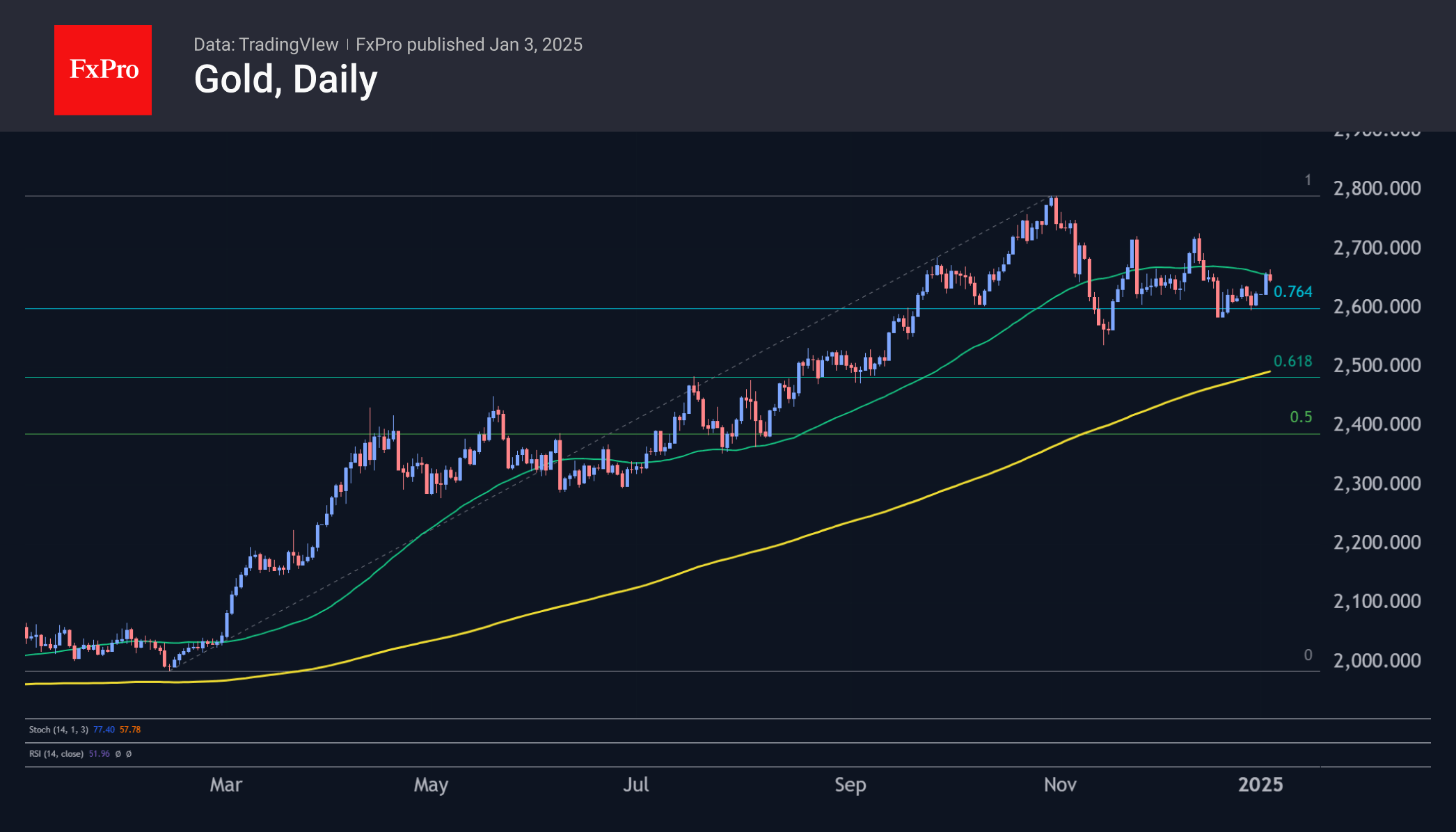

As with tariff uncertainty, the technical picture offers arguments for both bulls and bears.

Gold tested its 50-day moving average in the first trading session of the new year. A dip below it in November broke the uptrend and sent gold into a consolidation phase after a 12-month rally of more than 50%. Failure to stay above this curve for long in November, December and early January looks like a bearish signal: too many sellers looking to take profits.

However, the longer-term picture is bearish as the recent pullback looks like a shallow correction to the 76.4% level of the advance. Such shallow corrections are characteristic of strong bull markets. Breaking through the historic highs above $2800 in the next few months will signal the start of growth towards the $3400 area. The cancellation of this scenario will be a failure below $2550 ($100 below current prices), but even then, there is a chance that we will see a transition to a classic correction rather than a long-term reversal.

The FxPro Analyst Team