Gold has been on a downward trend since the end of last week, with the sell-off peaking in the first few minutes after reports that a trade court ruled that most of Trump’s tariffs were illegal. Having fuelled risk appetite, this news triggered a sell-off in the ‘defensive asset’. The positive traction ended rather quickly as the US President’s administration appealed.

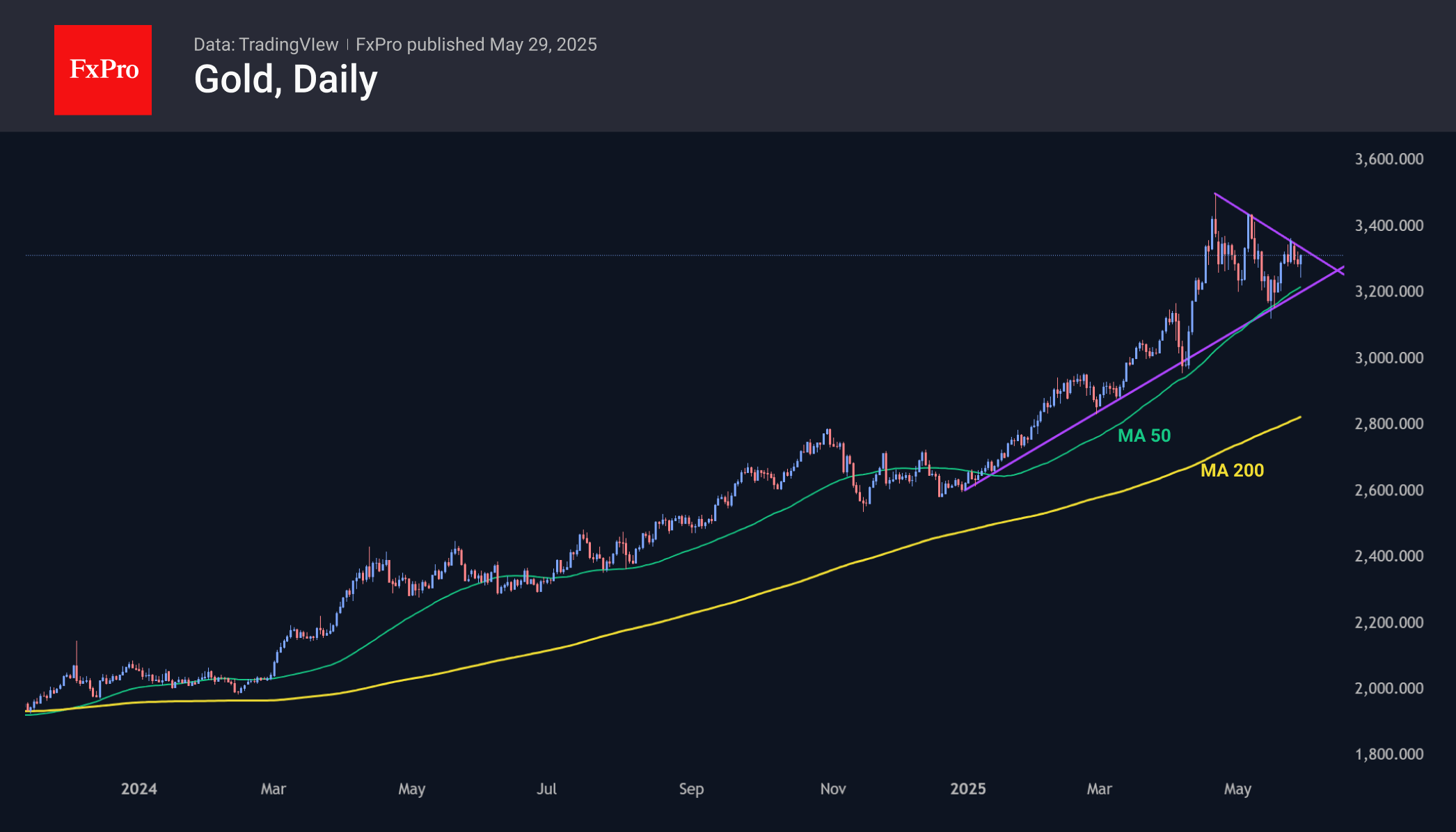

Gold managed to stay within this year’s pattern and was actively bought on an intraday dip below $3250, once again pushing the price away from the 50-day moving average. The dynamics are impressive as the price is adding about 2% to the intraday lows, reaching $3310 per ounce. In April and earlier in May, the price had already bounced off this curve, forming a sequence of higher local lows.

On the other hand, gold also has three successive lower peaks from the all-time highs in April, forming a line of downward resistance. This line is already being tested, and confirmation of its break will be a consolidation above the previous highs at $3365. It promises to be a prelude to a rise above the established historical highs at $3500.

The FxPro Analyst Team