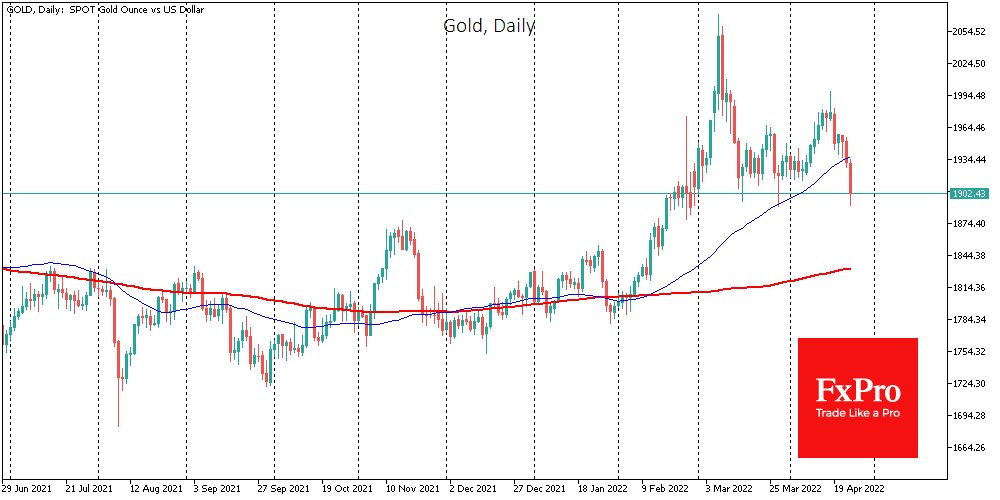

Gold lost 1.6% since the beginning of the day on Monday, testing $1900 precisely one week after an unsuccessful attempt to get above $2000.

The essential factor that puts pressure on gold is the Fed’s toughening rhetoric that triggers a broad sell-off of risky assets. Gold speculatively played its role as a haven for the war in Ukraine as it strengthened along with the US currency. Now gold is working as a commodity asset, turning into an anti-dollar with an inverse correlation to the US currency.

The sharp declines on Friday and Monday seem to have broken the bullish momentum that was formed at the beginning of February. Last week’s closing under the 50 SMA and the support areas of March and the first half of April did not attract new buyers. On the contrary, it looks like the bulls capitulated locally.

In just a matter of ten days before the Fed meeting, the gold might zero out the rally since the beginning of the year and go back to $1830 or get lower to $1780-1800 before we might see a new buying impulse.

The FxPro Analyst Team