Dollar

The dollar index corrected after four consecutive weeks of gains. This is typical when national currencies and bond markets come under pressure ahead of important elections. The U.S. is facing this right now, although the dollar is often seen as a safe haven in times of market turmoil. In this case, gold and cryptocurrencies are temporarily trying out that role. However, we would advise against getting carried away with the idea of a dollar crash or a catastrophic U.S. debt default. This idea seems to have damaged most of today’s investors.

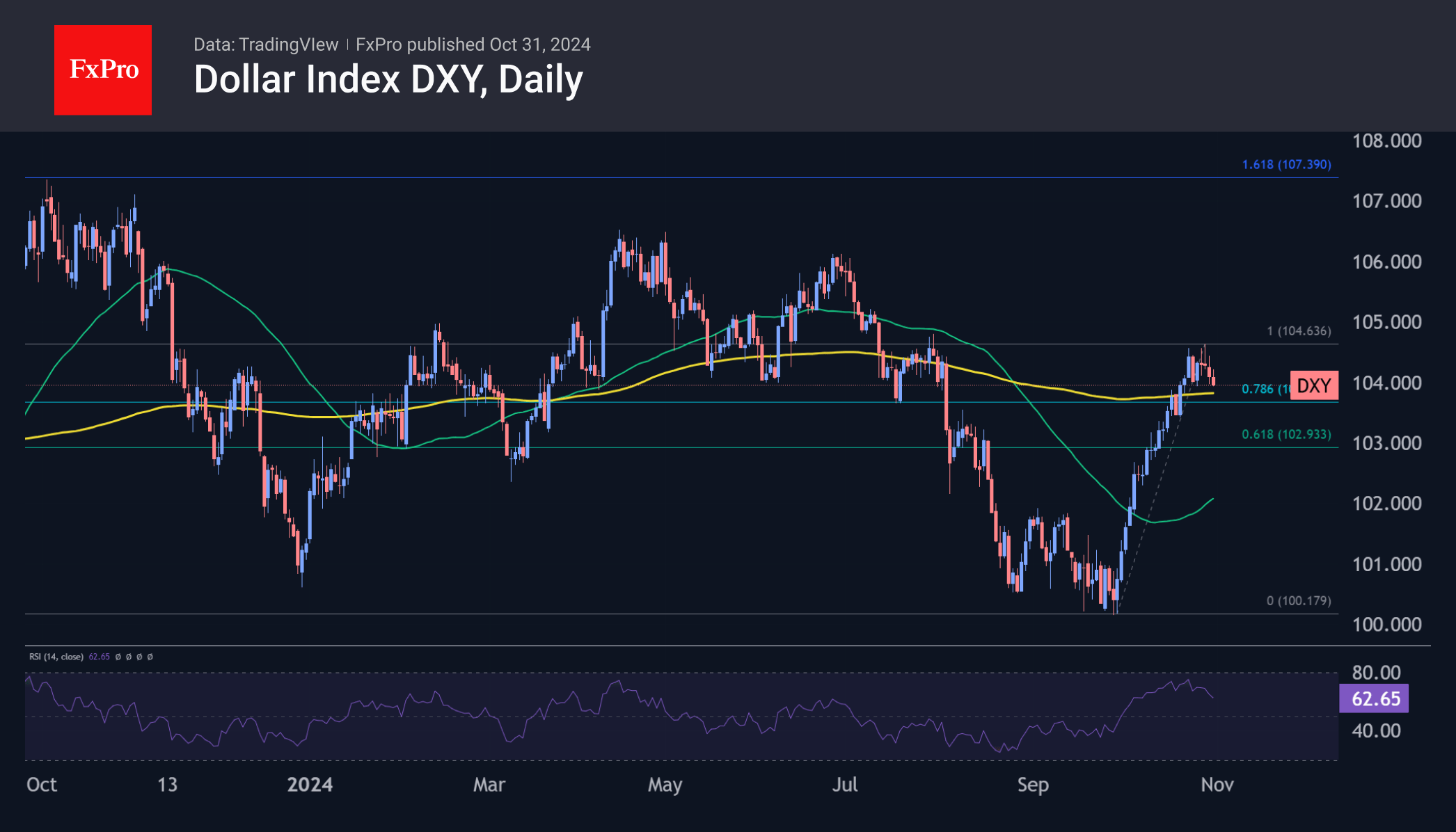

It is more reasonable to see the DXY decline as a pullback after a month of growth. The tactical targets for this correction are 103.8 and 102.8. The former is 76.4% of the initial advance and the 50-week moving average. The latter represents a pullback to 61.8% of the advance, which could fully recharge buyers.

Gold

Gold is in its fourth consecutive week of gains, the last three of which have been in the mode of regularly updating all-time highs. In futures, the price rose above $2800 per troy ounce, while the spot price stalled slightly as it approached this level. The current rally began in October last year with the first signs of a monetary policy shift. In less than thirteen months, the price has risen by 50%.

On a weekly basis, the RSI index has breached the 80 mark. This is only the sixth time in the last fifteen years. Corrections have always followed, with the lowest being a 5% correction in April this year. On other occasions, pullbacks have been between 8% and 20%. But there is an important caveat to this tactic. A signal for a correction begins when the asset returns from overbought territory; before this point, going against the trend is challenging, as price changes can be highly volatile due to waves of short-position margin calls.

The FxPro Analyst Team