Since the end of last week, the price of gold has risen by more than 3%. With a high of $1879, it was temporarily rose to highs since last June.

Biden’s warning that Russia could invade Ukraine “at any moment” triggered a broad sell-off in Europe and several emerging markets and tangentially affected the US equity market. Recent events have brought back interest in assets that have benefited from decades of tension: gold has risen as insurance against currency destabilisation, and oil has risen on fears of a surge in demand and a shortage of supply.

Geopolitics give a shaky ground behind this growth, so investors should be wary of joining gold’s rise. It is impossible to predict whether the next move will escalate or de-escalate. Now, there are far more signs that the peak of tension is behind us, yet gold continues to gain today.

Likely, the fundamental demand for gold is now driven by a desire to preserve the purchasing value of capital amid inflation and ongoing price shocks across a range of commodities.

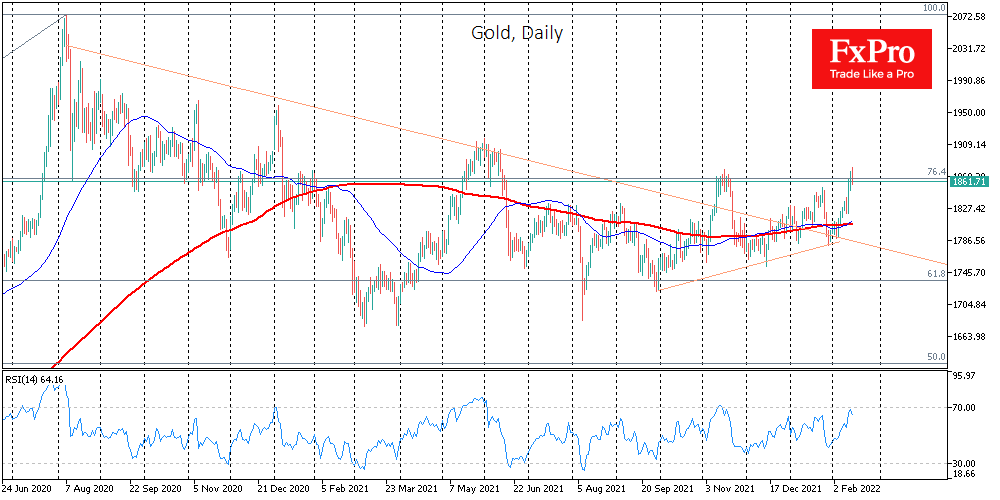

Also, tech analysis is now on the side of the bulls. A trend of higher local lows has formed since the end of September, with the last anchor point in late January. In addition, the 50-day moving average is again above the 200-day moving average, giving a bullish “golden cross” signal. This signal coincided with a solid upward momentum on Friday, strengthening the bullish signal. In January, the former retracement resistance line became support, indicating a break in the trend.

If gold stays above $1865 – the area of the November peaks- despite the reduction of the geopolitical premium – we can speak of a bullish momentum development. In this case, the nearest target of this impulse will be the area of $1900-1910.

In general, we can say that the long period of correction and sluggish dynamics of gold is over, and then its price can move from one local top to another, potentially exceeding $2000 by August.

The FxPro Analyst Team