Tightening monetary conditions in developed countries are not hurting gold so far, and investors’ switch from buying risky stocks generates demand for the safe-haven.

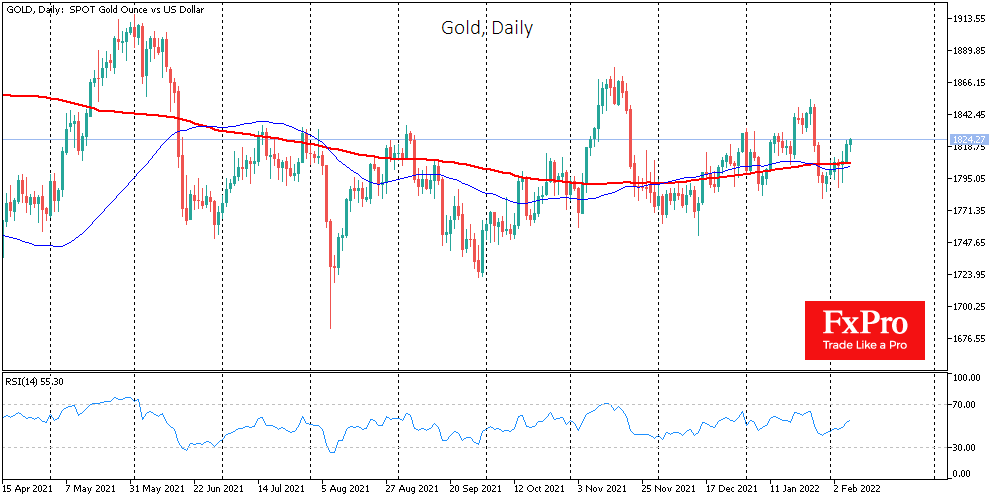

The daily charts also clearly show gold being repurchased in downturns. Since late last year, impulsive drawbacks on hawkish Fed comments are pushing the price down, but this momentum is not turning into a trend. Buyer support comes from higher and higher levels, although these purchases are measured and tempered, typical for long-term buyers.

Such buyers could be central banks, which could diversify away from the dollar and the euro. But there could also be funds that want to stay away from bonds falling in price (on rising yields) at a time of steep rate rises.

We can see the increasingly higher lows from August last year on the monthly candlestick charts for gold. So far, high inflation rates and market caution have not allowed a sustained upward trend in the price. However, the presence of solid buyers could revive buying very soon.

An important reason for this could be developments in the Eurozone. Rising market interest rates are hitting the region’s debt-laden periphery countries twice as hard. Investors may be worried about a repeat of the sovereign debt crisis of 2009-2011. Back then, investors used gold as a protective asset, losing confidence in the debt of almost half of the eurozone countries.

It is too early to say that a repeat of the debt crisis is imminent, but early signs of a jump in Greek and Italian bond yields are forming a support for gold. If this trend turns into a problem, active buyers of safe havens promise to become many times more numerous.

The FxPro Analyst Team