The strengthening of the US dollar and higher Treasury yields have pushed the gold price back below $ 4,000. Yellow metal is gradually losing its wild cards. It managed to reach a record high thanks to devaluation trading, expectations of aggressive monetary expansion by the Fed, Donald Trump’s threats of 100% tariffs against China, geopolitics, pessimistic forecasts for the global economy, and active purchases of bullion by central banks.

However, the White House is no longer attacking the Fed as aggressively as before. The US and China have found common ground. The Middle East conflict has been resolved, and the global economy is proving resilient in the face of tariffs. The Fed is cautious about lowering rates, and central bank activity in the bullion market is declining.

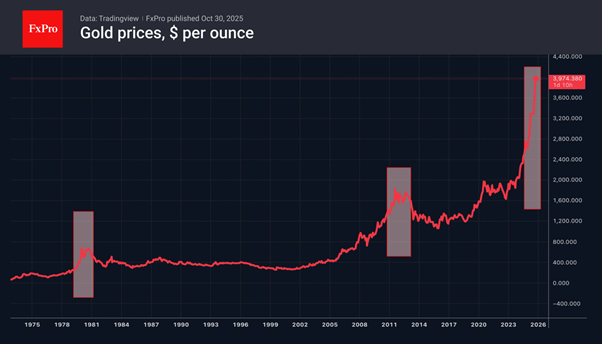

The other two examples of similar gold price rises were 1979 and 2011. The experience of those years shows that the surge and collapse were followed by long periods of consolidation. In other words, after a period of retreat from the top, the precious metal will find its trading range and settle within it. But for the weeks ahead, we continue to see more risks of further decline.

The FxPro Analyst Team