Gold had made impressive moves yesterday before active trading in New York. Still, comments from Fed officials, combined with the release of relatively strong industrial production data, pushed the price back almost $30 to $1990, where it remains at the time of writing.

The Fed’s Loretta Meister noted yesterday that US interest rates have not yet reached a level where the central bank could stop tightening, given the resilience of inflation. Influential Fed member John Williams noted that inflation is “gradually moving in the right direction” but remains “unacceptably high”.

In addition, the bond markets took a positive view of the outcome of the McCarthy-Biden meeting to discuss the debt ceiling, although no agreement was reached.

The market also reacted positively to the Fed’s report on industrial production growth of 0.5% in April, of which the manufacturing sector added 1%, much higher than expected.

As a result, the market is again pricing in more than a 20% chance of another rate hike in mid-June. These are far from extreme levels, as the probability has been above 30% since the second half of April. Nonetheless, this revision of expectations is creating some pull for the dollar. The dollar index has risen by 2% since last week, putting pressure on precious metals and cryptocurrencies.

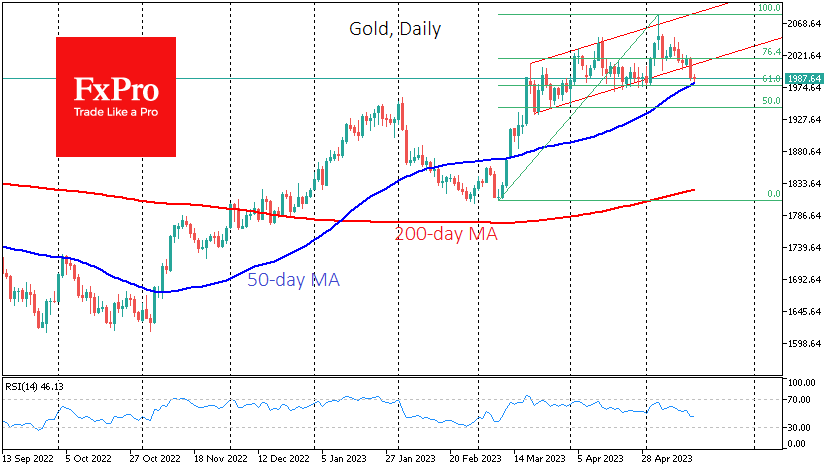

As a result of yesterday’s fall, gold has broken out of the bullish range formed at the end of March. Gold is now close to the April lows from which it was then supported.

At the same time, gold is approaching its 50-day moving average, above which it rallied at the end of last year and confirmed in March. At just below $1970 is the 61.8% retracement level of the rally from the March lows to the early May highs.

From this perspective, a sharp pullback below $1980 would be an essential signal of a change in market sentiment, forcing a further drop to $1950 (the February high).

However, the fall below the $1980 scenario does not yet appear mainstream. The recent pullback has cleared the overbought conditions on the daily timeframes and opened the way to the upside.

The next advance could take gold to new highs if it finds some support. A technical target for the bulls could be the $2250 level, representing 161.8% of the last two-month rally. The 12-month target for the gold bugs seems to be an ambitious $2640.

The FxPro Analyst Team