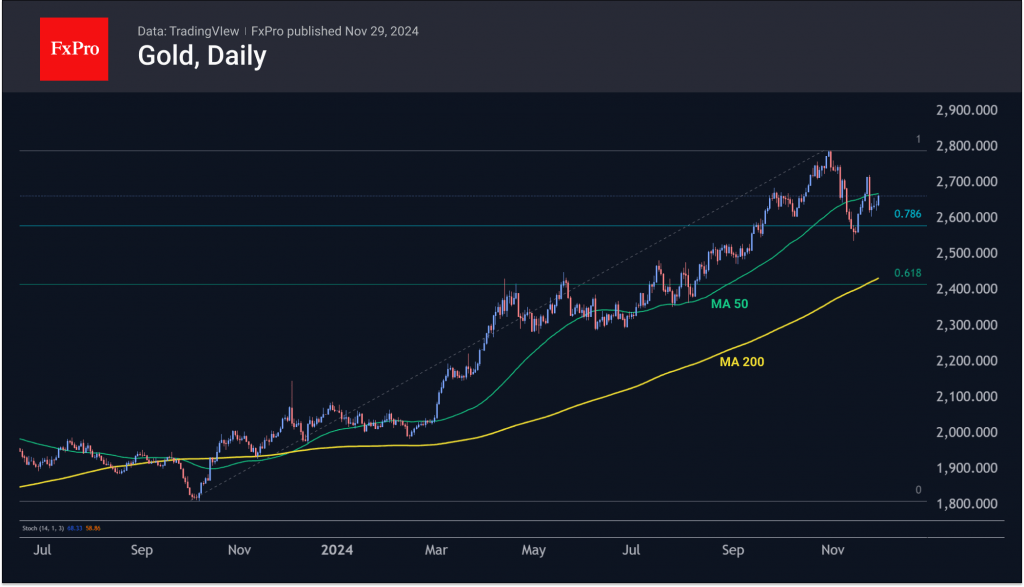

Gold fell 4% at the start of the week due to the ceasefire between Lebanon and Israel but has since recovered around half of that fall. The price found support at $2,600 per troy ounce, which also provided support in late September and early October.

Technically, the sharp dip is an important signal that the bears are in control, having taken the price below the 50-day moving average shortly after attempting to consolidate higher.

However, confirmation will now be key. A further drop below $2,600 would make the area of this month’s lows at $2,540 the short-term target for the sellers, with the market continuing to move towards $2,400. The long-term target, in this case, is the $2,000 an-ounce area.

The slow but steady rally from Tuesday to Friday suggests cautious buying, indicating continued interest even at current historically high levels. A weekly and monthly close above $2,670 could be a signal for further gains, marking a return to territory above the 50-day moving average. A further rally above $2,720 (previous highs) would dash hopes of forming a trend of lower local highs. In that case, the chances of a further attack on the historic highs will increase sharply, with a potential target of $3,400, representing a 22% increase from the previous highs and almost 28% from the current price.

For now, however, it makes more sense to move in small steps.

The FxPro Analyst Team