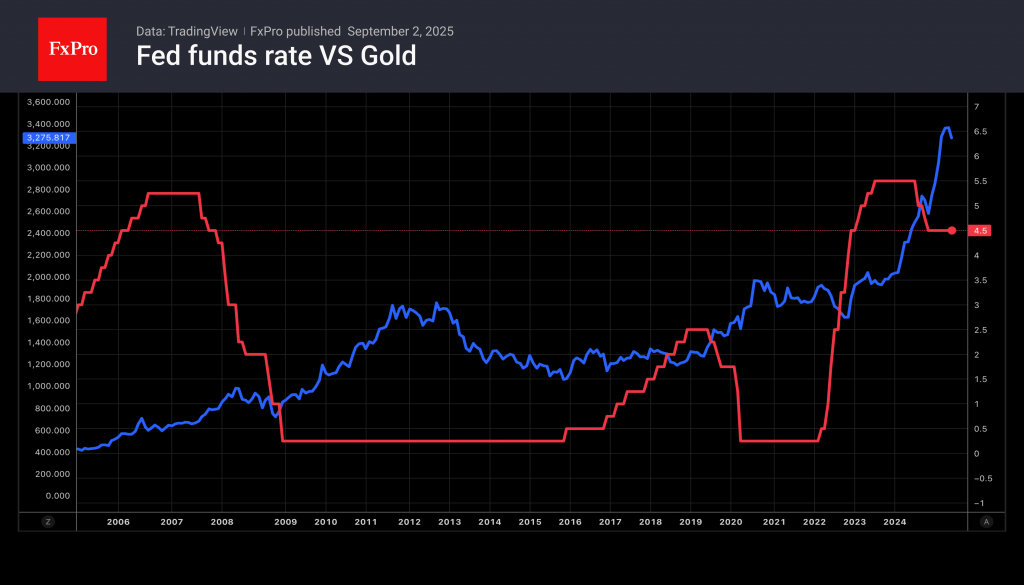

Gold has reached a new all-time high thanks to growing trade uncertainty, the Fed’s willingness to cut rates, and central banks’ intentions to step up their bullion purchases. The precious metal found the strength to break out of the medium-term consolidation range between 3250 and 3400 dollars per ounce, where it had spent most of its time since April.

Expectations of a Fed policy easing in September created the necessary tailwind for gold. However, the main catalyst for the rally was the Federal Appeals Court’s ruling that Donald Trump’s tariffs were illegal. International trade plunged into chaos, and demand for safe-haven assets rose. That is when Gold retook the reins.

The White House has no intention of giving up. It is set to appeal to the Supreme Court. If that fails, other laws will be used to justify the tariffs. Success with tariffs on steel and copper imports could turn into levies on precious metals. Palladium and silver have already been added to the list of critical minerals. Another surprise from the White House, and gold will surge towards 4000.

Gold is considering a potential increase in central bank activity. In the second quarter, they slowed down their purchases of bullion. However, Brazil’s convening of a virtual BRICS meeting may accelerate this process. The summit is dedicated to tariffs. The deepening divide between the West and the East is creating the necessary conditions for de-dollarisation and diversification of gold and foreign exchange reserves. Thanks to this, the price of the precious metal has more than doubled in the last three years.

Gold bugs feared that the dialogue between the US and Russian presidents in Alaska would lead to peace in Ukraine. A reduction in geopolitical risks is negative for the precious metal. In fact, no breakthrough has occurred, and the armed conflict continues. As Nathan Rothschild once said: ‘’The time to buy is when there’s blood in the streets.’’

Another reason to buy gold is the growth of political risks in France. The right-wing National Rally party will not be satisfied with François Bayrou’s government’s resignation and is set on holding early parliamentary elections. Growing uncertainty in Europe is boosting demand for gold.

The FxPro Analyst Team