- The US Dollar decline looks like a part of the White House’s plan.

- Gold is rising on capital inflows.

Donald Trump has added fuel to the fire of the falling US dollar. The president’s words that the value of the dollar is ‘great’ underlined that US officials are comfortable with the dollar’s decline, only reinforcing the drop to its lowest level since February 2022. This is causing a rally of the main forex pair to 1.20, despite the forecasted 5.4% growth in US GDP in the fourth quarter, and the FOMC’s unwillingness to cut rates until at least June, according to leading indicators from the Atlanta Fed.

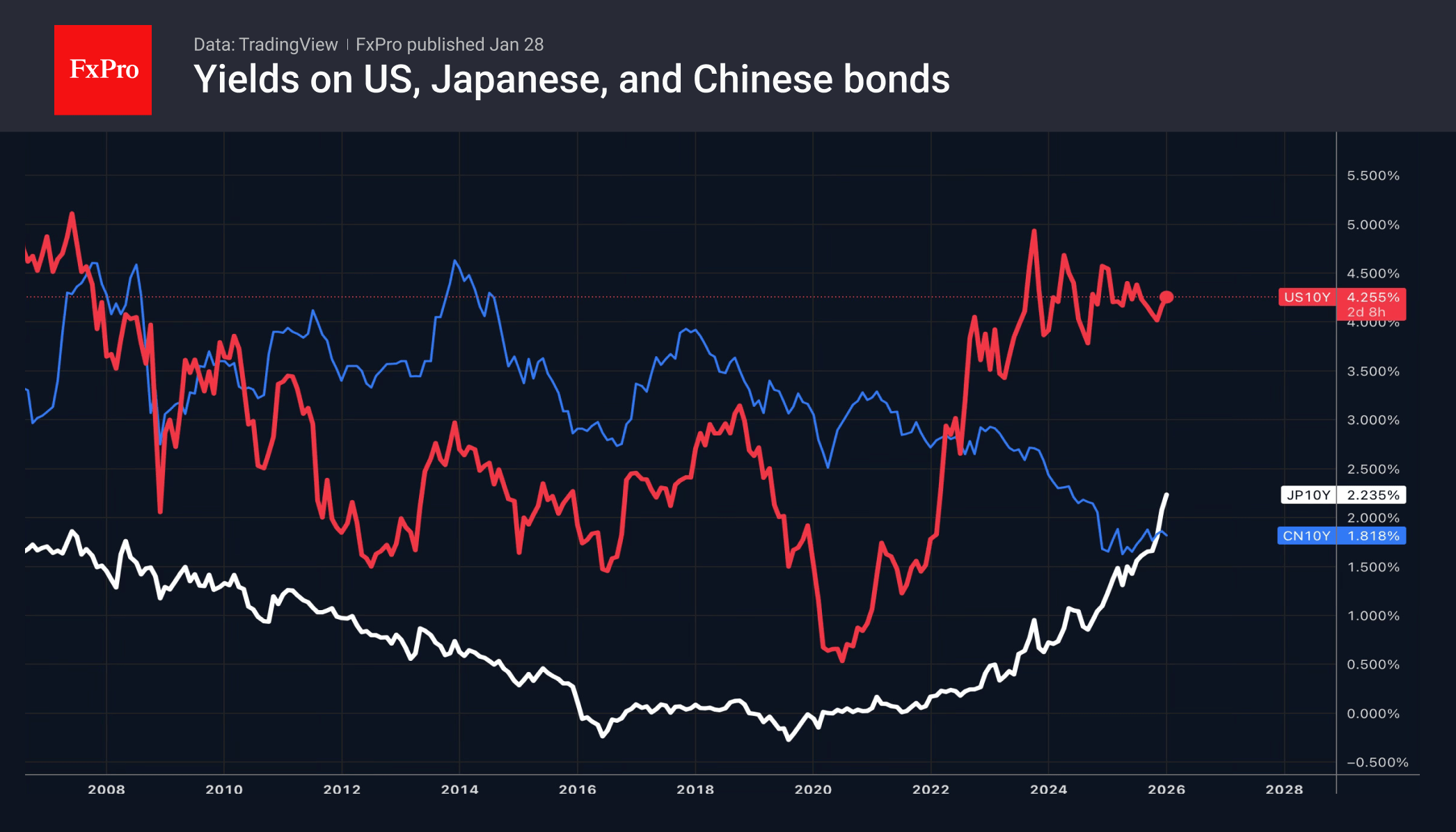

The White House is sticking to its guns. In Davos, Trump asked a rhetorical question: why is the US economy strong, the risk of default low, and interest rates higher than in other countries? The United States pays 4.2% on its 10-year debt, while Japan pays 2.2% and China 1.8%. And this is a heavy amount ticking on top of the $38 trillion debt, a staggering additional cost to the budget.

Donald Trump wants to reduce borrowing costs. The Fed’s models show a direct link between a strong economy and the risks of accelerating inflation. However, fundamental analysis suggests that a strong economy cannot have a weak currency. The example of the US dollar shows that it can.

Will the Fed put a spoke in the wheel of the EURUSD bulls? Jerome Powell can do so with his hawkish rhetoric. However, if the central bank retains the phrase about considering additional rate adjustments in the accompanying statement, this could, on the contrary, accelerate the fall of the dollar. The markets will perceive such a move as a signal of resistance to a prolonged pause in the cycle of monetary expansion.

The collapse of the USD index allowed gold to break above $5,300 per ounce for the first time in history. Precious metals act as a politically neutral asset. They react to White House policy but are not dependent on it in the same way as stocks, bonds and the US dollar. As a result, investors are increasing their gold holdings to hedge against political risks.

Gold got support from both capital flights from the US and capital outflows from the cryptocurrency market. Many believed that Donald Trump’s promise to turn America into the world crypto capital would cause Bitcoin to break record after record. In fact, it has become an asset dependent on White House policy.

The FxPro Analyst Team