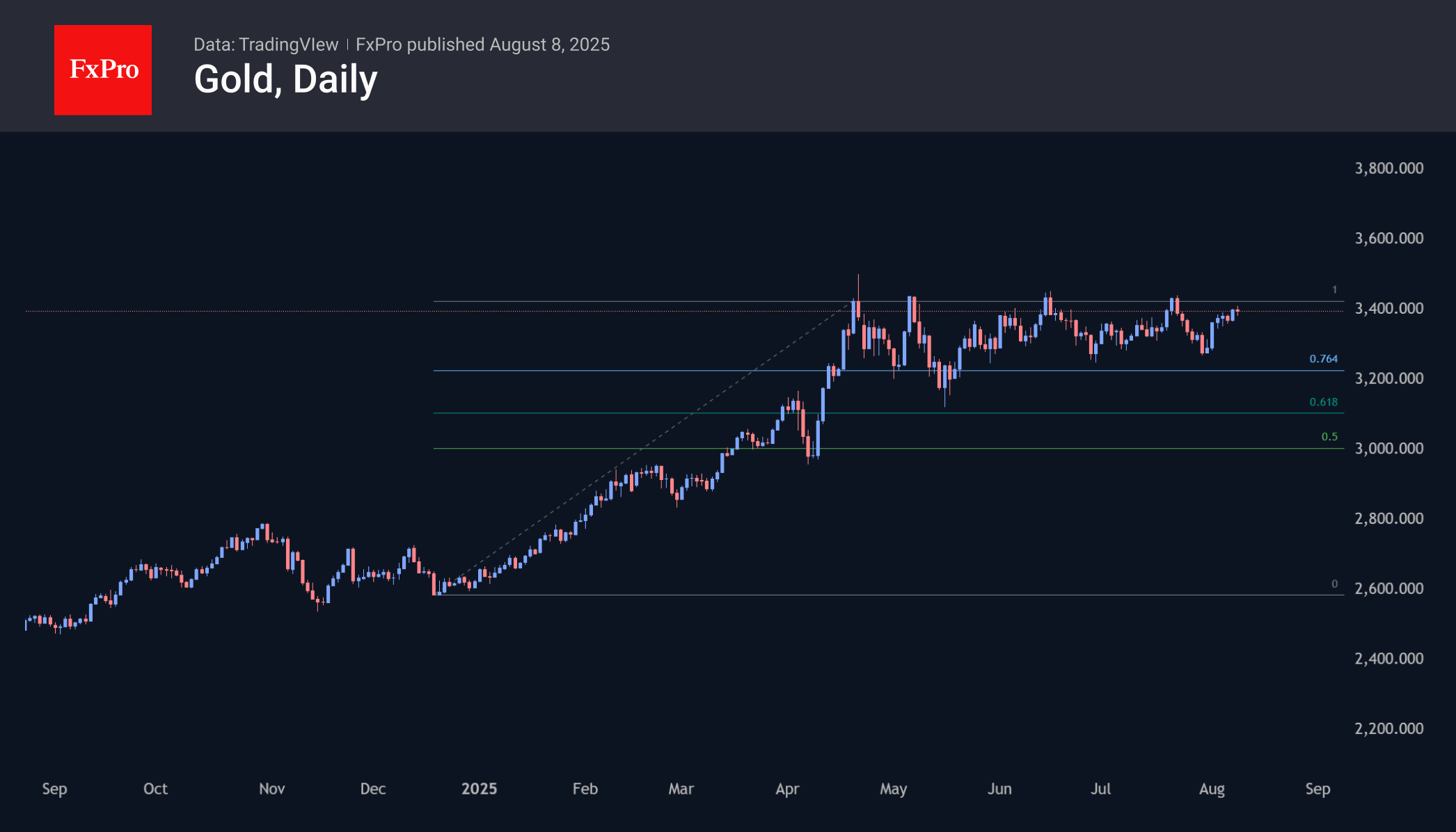

Gold quickly recovered and approached the upper limit of the medium-term consolidation range of $3,250-3,400 per ounce, thanks to the return of fears of stagflation in the US, the growing likelihood of a Fed rate cut in September, and frenzied demand in China. The employment sub-index in surveys of purchasing managers in the services sector has fallen for the fifth time in the last six months, while prices are rising rapidly.

Stagflation is good for gold, as low growth prevents the Fed from tightening while inflation is eroding the value of dollar assets. Precious metals are used as a hedge against inflationary risks.

After a long period, the outlook for gold has been looking more bullish. The dramatic reversal in expectations regarding the Fed’s interest rate cuts and accelerating inflation creates the ideal background for gold. The decline in demand from central banks and the jewellery industry is offset by a decrease in above-ground stocks outside exchanges due to arbitrage operations.

If the upper boundary is broken and a bullish rally begins in gold, there is potential for a slide down to $3950-4000, where the 161.8% extension levels from the rise from the lows at the end of last year to the resistance area from the end of April near $3420 are concentrated.

The FxPro Analyst Team