Gold is trading near $1840, adding 3.2% from the Jan 7 lows, as a hedge against increased financial market volatility. By comparison, the S&P500 has experienced its worst start to a year in history, losing more than 12% in that time in response to the harsh tone of US monetary policy comments.

At a point like this, we often see a divergence in the dynamics of gold and equities, which revives talk of a safe haven. However, investors should not forget that increased equity market volatility, if it lasts long enough, at some point triggers a capitulation of gold buyers.

The critical question for investors now is when there is a switch between a favourable decline for gold and a real fear triggering a circular sell-off in all assets. We are looking at the performance of the yen and the franc. Both currencies are relatively protected from geopolitical risks on the Eurozone sidelines. So far, these currencies have moderately slid against the dollar, which suggests that we have not yet reached the point of reducing leverage.

This means that a relatively positive background also remains for gold, which allows us to talk about a continuation of the positive trend of the last two months for the time being.

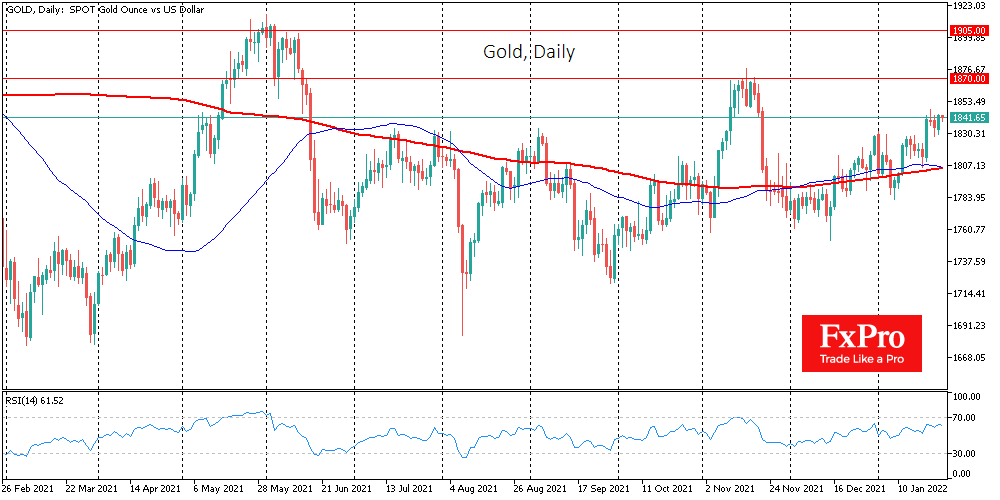

The next central resistance area looks at $1870-1905, between the last two peaks. Among other factors, gold may be hampered by further declines in the stock indices if yesterday’s bounce attempt does not materialize today.

A move above $1900 would signal the end of a long-term correction in gold and start a new momentum of growth above $2500, which would last for up to two years. The opposite is also true. A pullback under $1800 would end the long upside attempt and the long consolidation.

The main near-term unknown is the outcome of Wednesday evening’s Fed meeting. The central bank’s statements and comments could determine the other trend of gold, supporting or, conversely, reversing the latest upside attempts.

The FxPro Analyst Team