Gold is trading above $3,400 again at the end of the week. The upper limit of the trading range, within which the price has been fluctuating since April, is close to $3,430. Jerome Powell’s signals about a rate cut, unprecedented pressure from the White House on the Fed, and the continuing high level of geopolitical risks have brought the price back to this level. Washington’s introduction of 50% tariffs against India risks further deepening the divide between the West and the East, as well as the associated processes of de-dollarisation and diversification of gold and foreign exchange reserves by central banks in favour of precious metals.

For the first time since 1996, central banks hold more gold (about 25%) than US government bonds (about 20%) in their gold and foreign exchange reserves. For comparison, between 2008 and 2015, this ratio fluctuated between 10% and 30%, respectively.

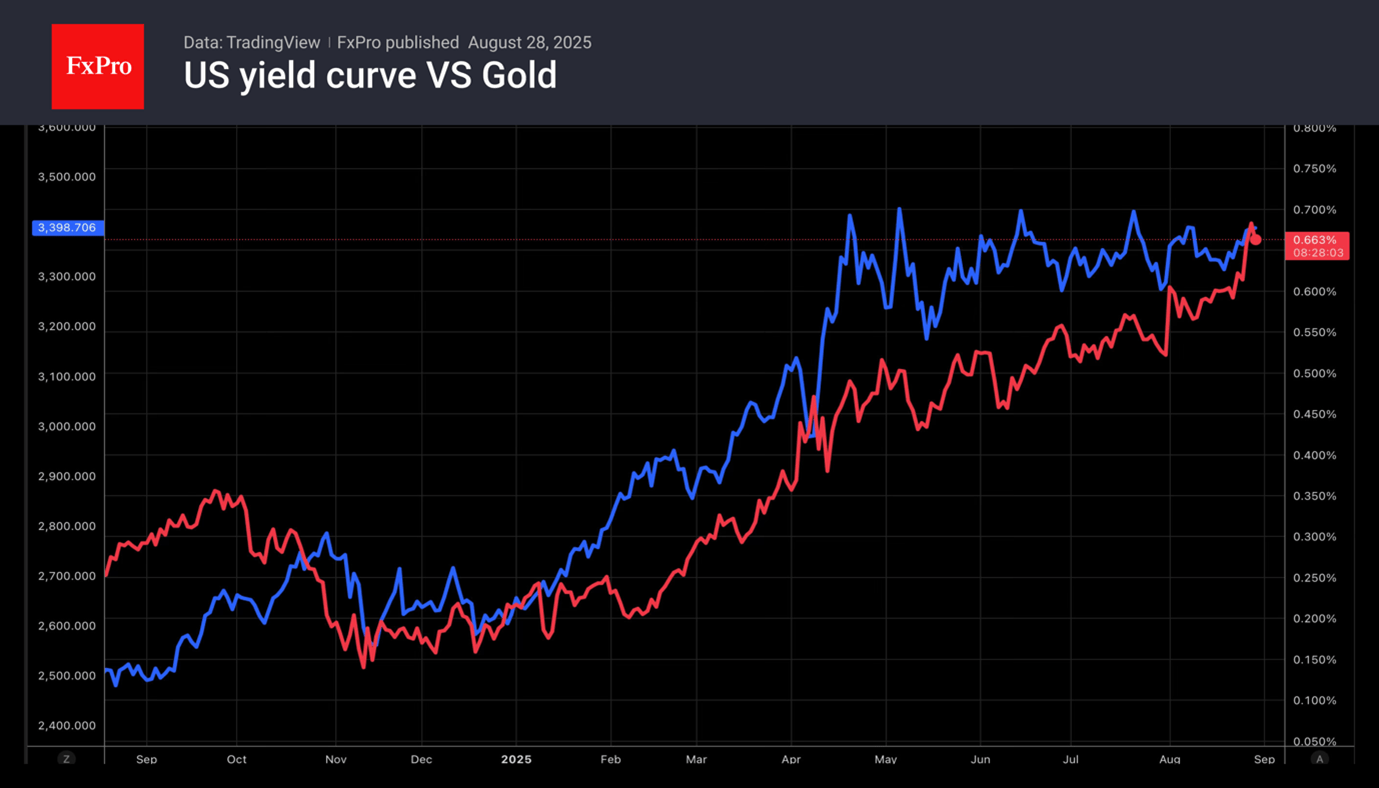

Gold bulls are drawing strength from the dynamics of the US yield curve. Yields on 2- and 10-year Treasuries are falling. The market is painting a stagflationary backdrop, which is the best food for gold bugs.

Gold’s ability to break through the resistance zone above $3,430 will be an important signal of the market’s readiness to return to a rally after four months of tug-of-war. But it is worth being cautious with early bullish bets at these levels. Formally, there is now a greater chance of another pullback to the lower end of the range at $3,300-3,315.

At the same time, investors should remember that whichever way the breakout occurs, the subsequent movement could be very strong, given how long the gold market has been gathering strength while remaining in a sideways trend.

The FxPro Analyst Team