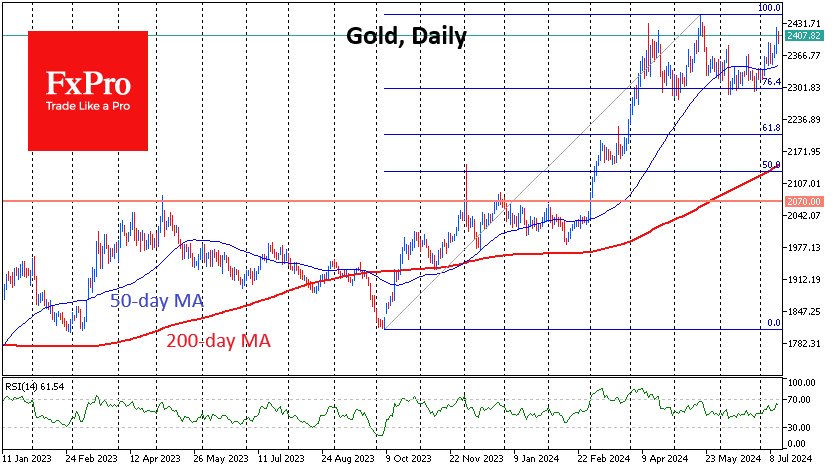

A soft US CPI report pushed gold above the $2400 mark. The price only climbed above it for a couple of hours in April and barely spent three days above this level in May. In both cases, these climbs shifted the balance to the sellers, followed by a dip below $2300. These episodes may have created a knee-jerk reflex, as the troy ounce price was down about 1% on Friday due to a relatively elevated risk appetite.

The gold price is approaching the upper end of the range of the last three months, which could be the end of a consolidation after rallying off the lows of October. There is logic to this idea, as this rally started on policy reversal signals. Recent months have been shrouded in uncertainty due to mixed inflation numbers. And now we are registering a rather high degree of willingness of the Fed officials to start easing soon.

From the technical analysis perspective, the potential upside target in gold in case of a resistance breakout is the level of $2850.

The FxPro Analyst Team