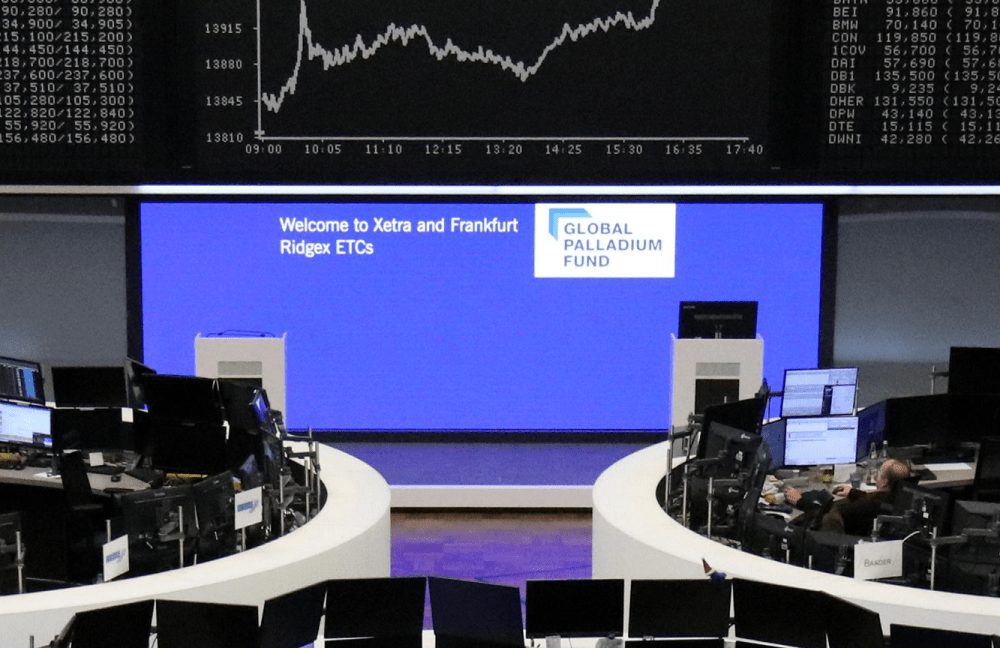

Global shares rose to just shy of records highs on Monday, as optimism over a $1.9 trillion U.S. stimulus plan outweighed rising COVID-19 cases and delays in vaccine supplies. European stock markets opened higher, with the pan-European STOXX 600 up 0.3%. The continent’s 50 biggest stocks were also up 0.3%. Germany’s DAX rose 0.2%, Italy’s FTSE MIB index jumped 0.6% and Britain’s FTSE 100 rose 0.1%. Spain’s IBEX and France’s CAC 40 faltered, down 0.1% each. A rally in U.S. tech stocks to near record highs on Friday helped fuel gains in their counterparts in Asia and Europe. A European basket of tech stocks gained 1.2%. In Asia, Chinese tech giant Tencent soared 11%.

MSCI’s All Country World index, which tracks stocks across 49 countries, was up 0.3% on the day. Global equity markets have scaled record highs in recent days on bets COVID-19 vaccines will start to reduce infection rates worldwide and on a stronger U.S. economic recovery under President Joe Biden. Investors are also wary about towering valuations amid questions over the efficiency of the vaccines in curbing the pandemic and as U.S. lawmakers continue to debate a coronavirus aid package.

All eyes are on Washington D.C. as U.S. lawmakers agreed that getting the COVID-19 vaccine to Americans should be a priority even as they lock horns over the size of the U.S. pandemic relief package. Financial markets have been eyeing a massive package, though disagreements have meant months of indecision in a country suffering more than 175,000 COVID-19 cases a day with millions out of work. Global COVID-19 cases are inching towards 100 million with more than 2 million dead. Despite the recent outperformance in tech stocks, investors have reiterated views that cyclical and value stocks will outperform as economies recover.

Global stocks rise on recovery hopes, Reuters, Jan 25