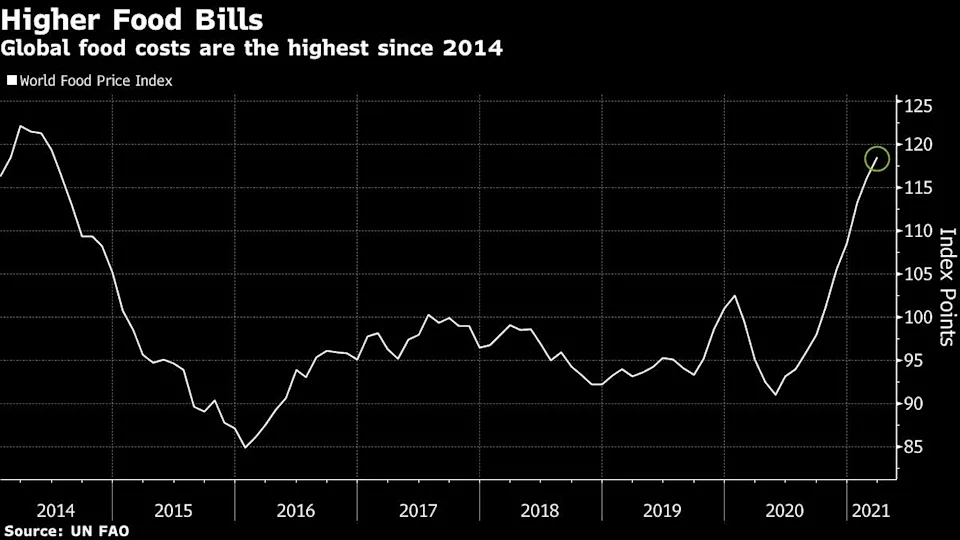

The global food-price rally that’s stoking inflation worries and hitting consumers around the world shows little sign of slowing. Even with grain prices taking a breather on good crop prospects, a United Nations gauge of global food costs rose for a 10th month in March to the highest since 2014. Last month’s advance was driven by a surge in vegetable oils amid stronger demand and tight inventories, according to Abdolreza Abbassian, a senior economist at the UN’s Food and Agriculture Organization.

Food prices are in the longest rally in more than a decade amid China’s crop-buying spree and tightening supplies of many staple products, threatening faster inflation. That’s particularly pronounced in some of the poorest countries dependent on imports, which have limited social safety nets and purchasing power and are struggling with the Covid-19 pandemic.

The FAO’s food price index rose 2.1% from February.Vegetable oil prices jumped 8% to the highest since June 2011.Meat and dairy costs rose, boosted by Asian demand.Grains and sugar prices fell. Grains prices recently climbed to multiyear highs as China imports massive amounts to feed its hog herds that are recovering from a deadly virus. Still, there are signs that tight supplies may get some relief from upcoming wheat harvests in the Northern Hemisphere.

Global Food Costs Keep Climbing in Threat to Consumer Wallets, Bloomberg, Apr 8