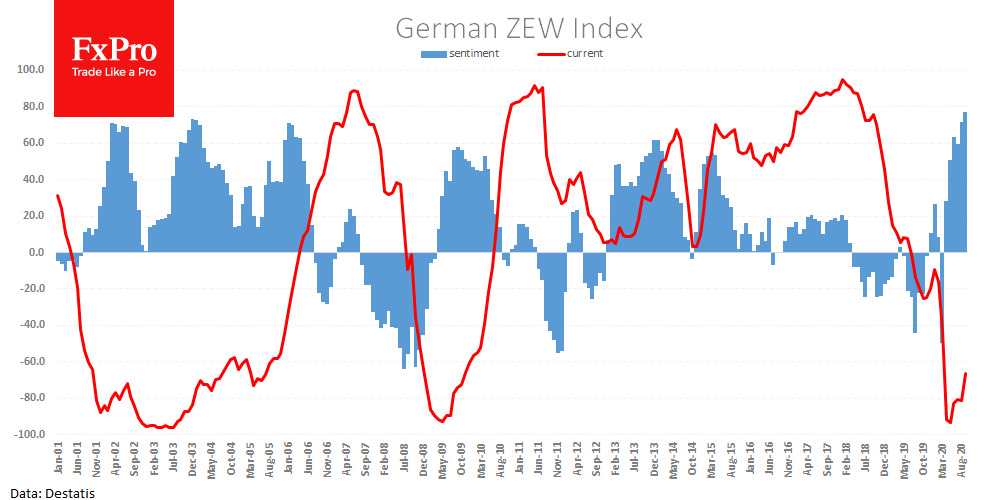

The positive mood of the markets got another boost during the day after the German ZEW Indicator of Economic Sentiment publication. Estimates for September showed an increase to 77.4 from 71.5 a month earlier. These numbers are the highest in 20 years, despite new rising COVID-10 cases and stalled Brexit talks.

The current sentiment index continues to recover after its extreme dip between February and March. The sharpest indicator drop in history is followed by an unprecedented speedy recovery, which is encouraging.

The publication of ZEW triggered a new buying wave in EURUSD, sending it back to test 1.1900. But the bulls are not yet in a hurry to cross this line, above which the pair has not been able to develop steady growth for a month and a half. It seems that the outcome of this fight will be delayed until after the Fed’s comments are published tomorrow evening.

The FxPro Analyst Team