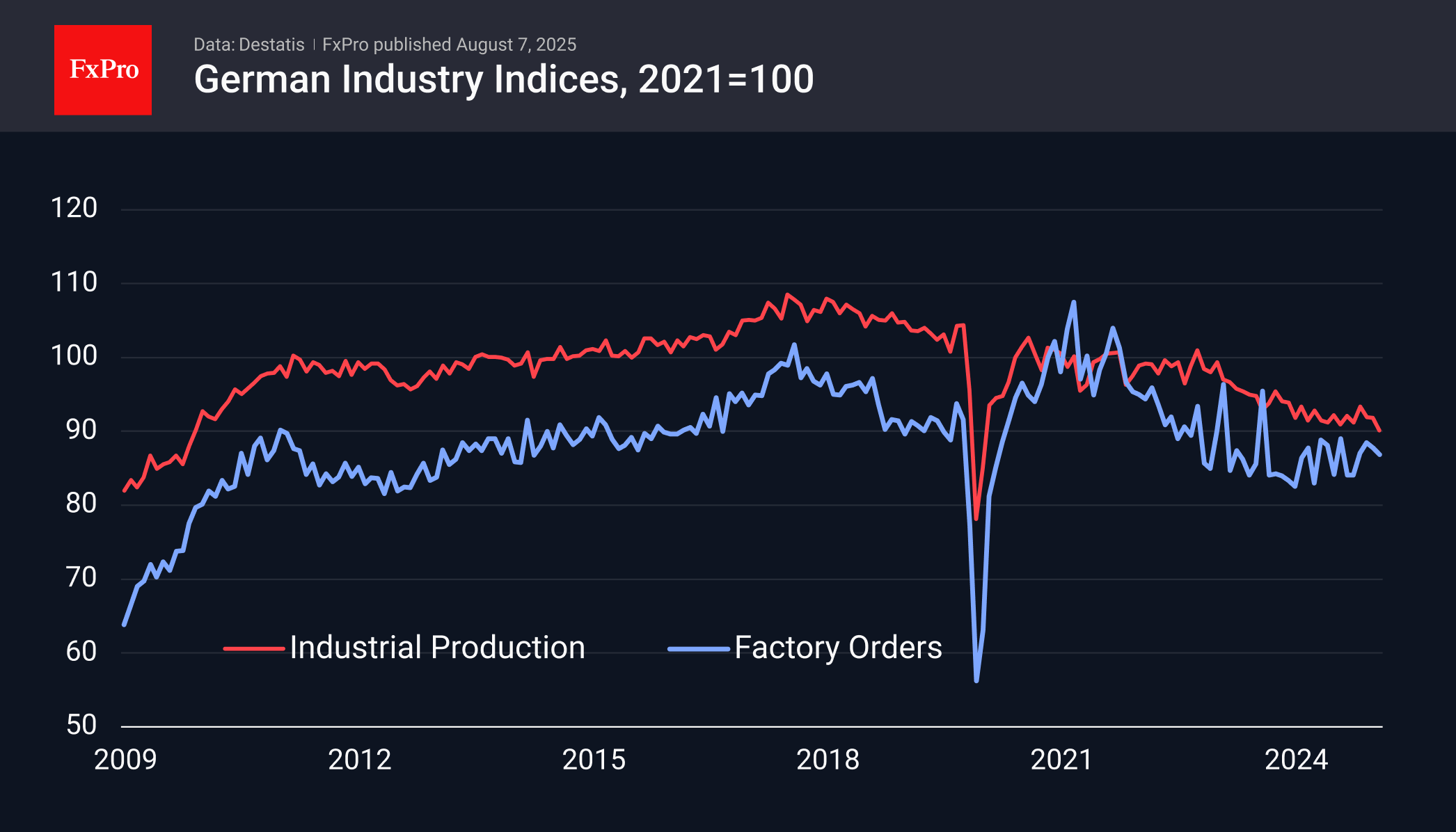

German industrial production has fallen sharply over the past three months, declining by 1.6% in April, 0.1% in May and 1.9% in June. The industrial production index is at its lowest level since April 2010, excluding a brief dip in March 2020.

The industrial production index stabilised and even increased last year and at the beginning of this year, but in recent months, the trend that has been evident since 2023 or even 2018 has resumed.

The industrial orders index has also been declining for the past two months, losing 0.8% in May and 1.0% in June, as reported on Wednesday. In such conditions, further pressure on production is to be expected.

The third factor is stagnant exports. Data released today showed a decline in the monthly trade surplus from 18.6 billion euros to 14.9 billion euros in June. Imports have been recovering since the beginning of 2024, from 104 billion euros to 115.6 billion euros in June, while exports have been hovering around 130 billion euros for almost three years.

The latest data is a cold shower for the euro, which is finding it increasingly difficult to grow as it approaches $1.17, given the importance of exports and industry for Germany and the whole eurozone. If other countries do not show more optimistic data on industry and exports, we should be prepared for a further reduction in the ECB rate, which is a bearish factor for EURUSD.

The FxPro Analyst Team