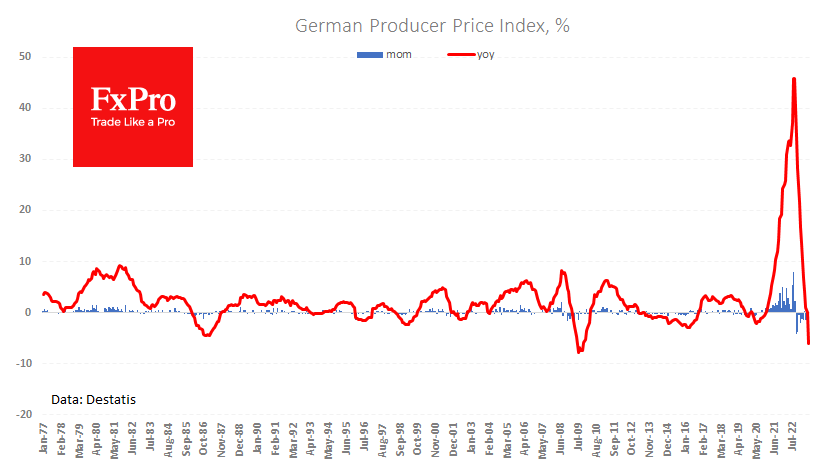

The sharp fall in German producer prices is both a signal of easing inflationary pressures and a warning of a sharp slowdown in demand.

The German producer price index fell by 1.1% in July, dwarfing the expected correction of 0.1%. Prices are 6% lower than a year ago, marking the sharpest annual decline since 2009.

The data shows how quickly producers are cutting prices after the value of imports fell 11.4% y/y in June. This momentum raises hopes that inflation in Germany may not be as sticky as in other advanced economies, where rising service costs and a tight labour market are pushing up final prices.

Rapidly falling prices and weak business sentiment indicators have brought Germany’s title ‘Sick man of Europe’ back into the spotlight, although such comparisons seem premature. Germany, which has often been resolute in its fight against inflation, may soften its stance.

In that case, the chances of further rate hikes by the ECB may diminish. Signs of a slowdown in the German economy, which is more exposed to China and Russia than other major eurozone economies, point in the same direction.

The German DAX40 is up 0.8% today, and the EuroStoxx50 is up over 1%, actively recovering from last week’s losses. This is fuelled by positive traction in US index futures and hopes the ECB rate hike is nearing its peak. Interestingly, the EURUSD is also rising, maintaining its positive correlation with equity market dynamics, temporarily having more weight on the market than the interest-rate differential perspective.

The FxPro Analyst Team