Market picture

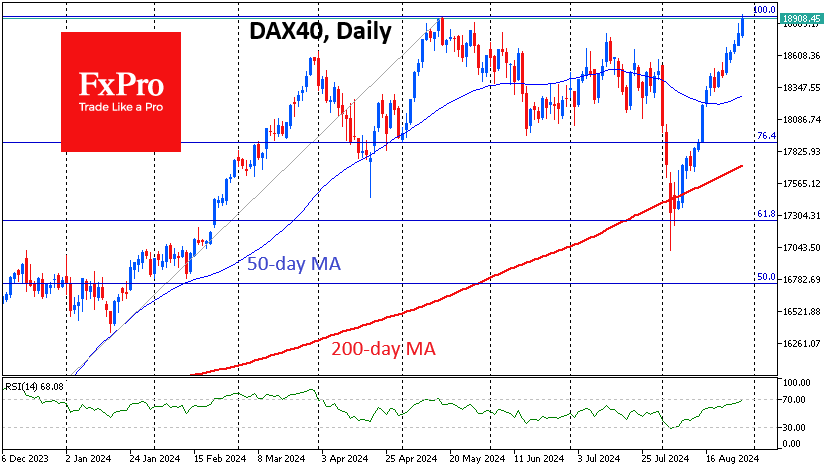

Germany’s DAX40 has returned to all-time highs above 18900. The sell-off in equities in early August lured investors waiting for a pullback to enter the market.

From a technical point of view, the August plunge was a corrective pullback. During this decline, the DAX40 fell to its 200-day moving average and found support near this level. At the peak of the sell-off, Germany’s benchmark index fell below the 61.8% Fibonacci retracement of the rise from the October 2023 lows to the May 2024 highs.

A successful breakout to new highs makes the 19500 area a potential near-term target. This is the 161.8% level from the October 2022 low to the July 2023 high. Similarly, we then saw a correction to 61.8% of the advance before the rally resumed.

Considering the targets from the current correction, there is a potential upside of 13% to reach 21500, which only seems reasonable in a few quarters’ time.

Drivers

Notably, the German equity index’s outperformance coincides with a strengthening euro (+3% against the dollar since the beginning of the month) and a weak economy. Market bulls may be using the latter factor as an excuse to buy in anticipation of looser monetary policy.

This is a rather risky bet from a macroeconomic perspective, as Germany is unlikely to be able to rely on demand from China or Russia, domestic stimulus or consumer demand in this growth cycle.

The main drivers are expected to be an easing of monetary conditions, making equity market returns more attractive, a recovery in lending, and a normalisation of interest rates. Monetary policy is an important factor, but it does not take the focus off the macroeconomy for long.

The FxPro Analyst Team