German inflation is cooling more than expected. According to preliminary estimates for October, price growth slowed to 3.8% y/y – the lowest in more than two years – and well below the expected 4.0%.

Harmonised (adjusted for tax difference), prices in Germany are now 3% higher than a year ago, which promises to drag down the figures for the entire eurozone.

However, the pressure on prices comes from several directions, from a shrinking economy to falling commodity prices. Germany’s economy shrank 0.1% q/q, having contracted in three of the last four quarters, and is now 0.8% lower than a year ago.

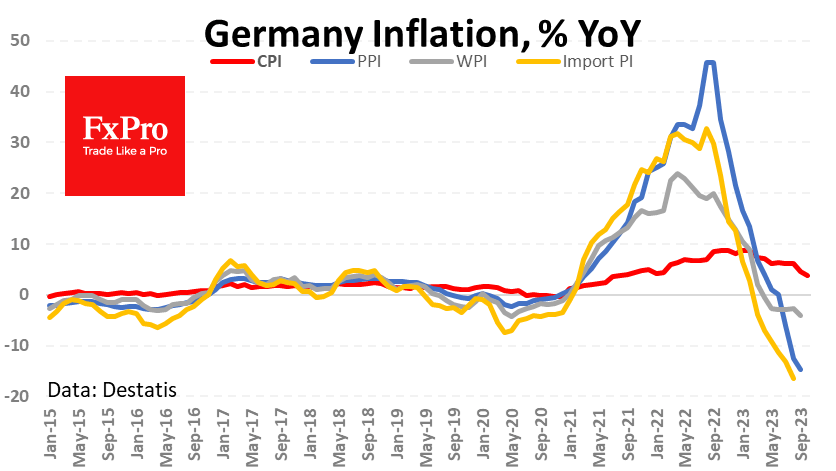

Leading inflation indicators show further pressure on consumer prices in the months ahead. Recent data showed a 16.4% y/y decline in the import price index. The producer price index in October was 14.7% lower than in the twelve months prior.

Lower import, producers and wholesale prices create room for selling price pressure while falling demand provides the necessary incentive to compete for customers.

A faster-than-expected return to normal inflation feeds the confidence that the ECB is finished with rate hikes and brings a potential easing date closer. This news is potentially negative for the single currency. However, EURUSD adds to the strong investor interest in the single currency near 1.05 and close to multi-year EURCHF lows.

The FxPro Analyst Team