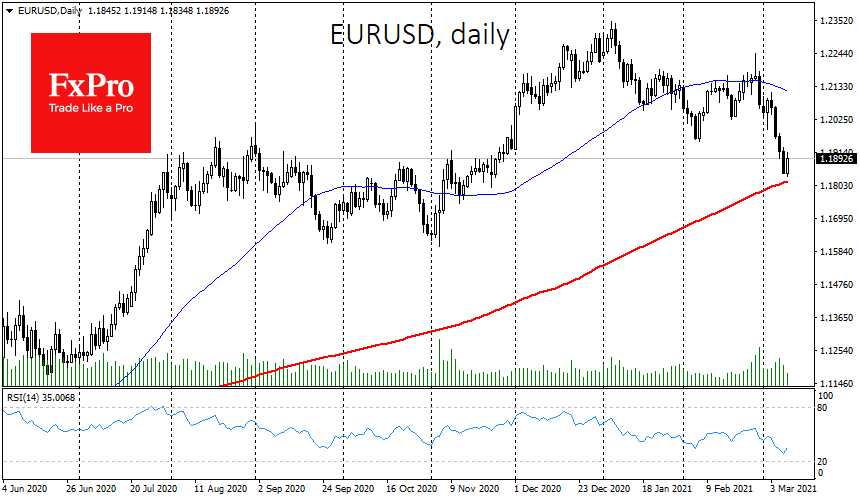

EURUSD reversed higher on Monday after four decline sessions, finding support near the 200-day moving average (now at 1.1815).

The rise in European markets was supported today by healthy data, including upward revisions to GDP and employment last quarter and Italy’s industrial production. But in more positive news for the euro, Germany’s solid trade surplus of 22.3B in January was markedly better than the forecasted 17.9B and 16.4B a month earlier.

The surplus reflects the inflow of money into the euro area. Furthermore, there is a speculative bet that it will continue to grow. However, this surplus is caused by a sharp decline in imports, which previously came at a challenging time for the German economy and caused pressure on the euro.

The fall in imports goes hand in hand with a downturn in the economy. Europe maintains a significant portion of the coronavirus restrictions, which could undermine the economy. Long-term, this is a bad sign for the euro as it postpones when the ECB can move towards policy normalisation.

The FxPro Analyst Team