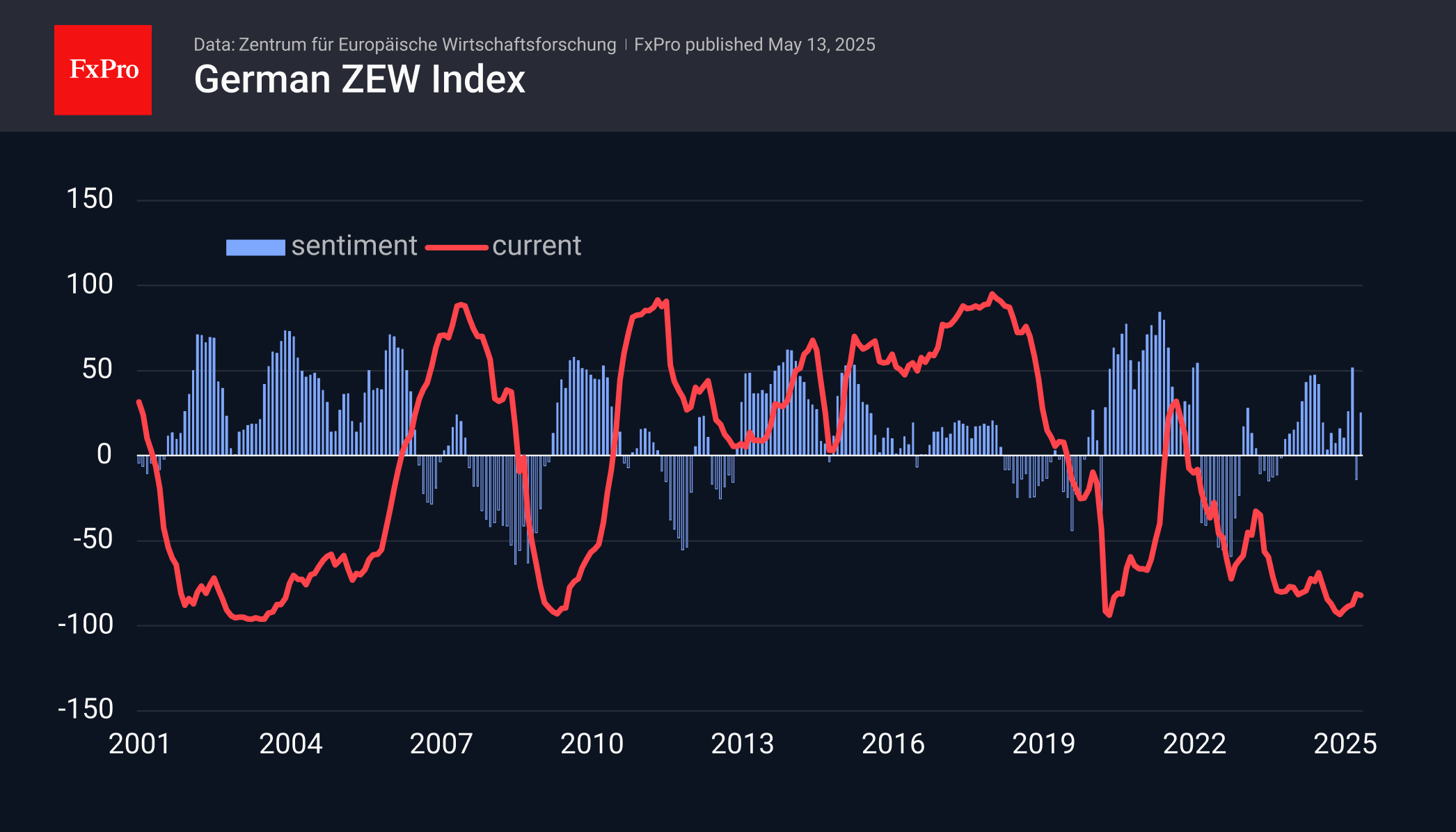

Business sentiment in Germany improved significantly in May after a sharp drop in April. The ZEW business sentiment index rose from -14.0 to 25.2, well above the average forecast of 10, but remains below the March reading of 51.6.

The improvement in sentiment is due to expectations of positive effects from the promised 800 billion stimulus package, progress in trade disputes, and stabilising inflation. However, the assessment of the current situation remains extremely low, with the index standing at -82, close to its cyclical lows in the current century.

The positive surprise in the business sentiment index creates a favourable news background for the EUR/USD pair, supporting it near the 50-day moving average. This line serves as a benchmark for medium-term dynamics, and a break below it will confirm the breakdown of the last three months’ uptrend. Holding the level of 1.11 indicates the willingness of buyers to continue buying.

The FxPro Analyst Team