There is growing evidence that equity markets are amid a deep correction from the run-up that began almost 12 months ago. The reaction of Europe’s significant indices in recent days has been telling.

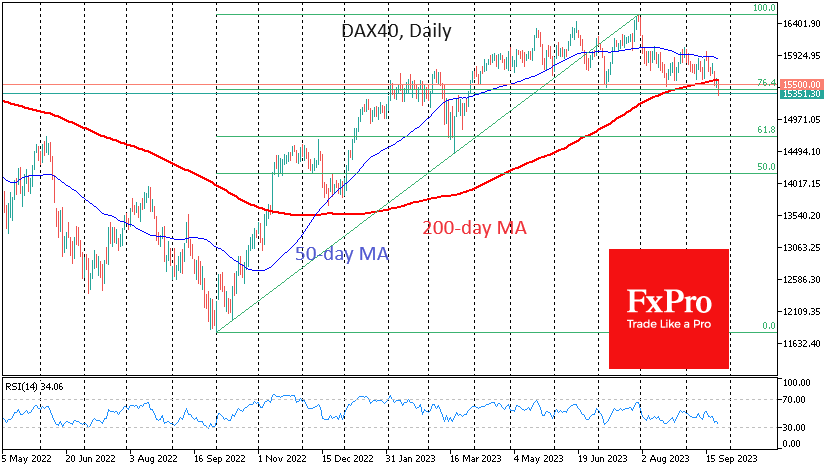

The German DAX40 fell below its 200-day moving average at the end of last week and is trading below it on Monday, coinciding with a critical support line at 15500.

As is often the case, the downward reversal followed the final capitulation of the bears in the last days of July, when the DAX40 hit a multi-year high above 16500. A few days later, the 50-day moving average became a resistance level, and the sell-off intensified when it was breached. The final reversal from upside to downside occurred on 15 September, and the new momentum took the index to new local lows.

The classic Fibonacci pattern suggests a corrective pullback will take the index to 61.8% of the original advance from 3 October last year. This line is near 14700. Another potentially attractive target for the bears could be the 14600 area, a pivot level from March last year. However, the DAX40 could go as high as 15000 rather quickly without encountering any significant support.

The FxPro Analyst Team