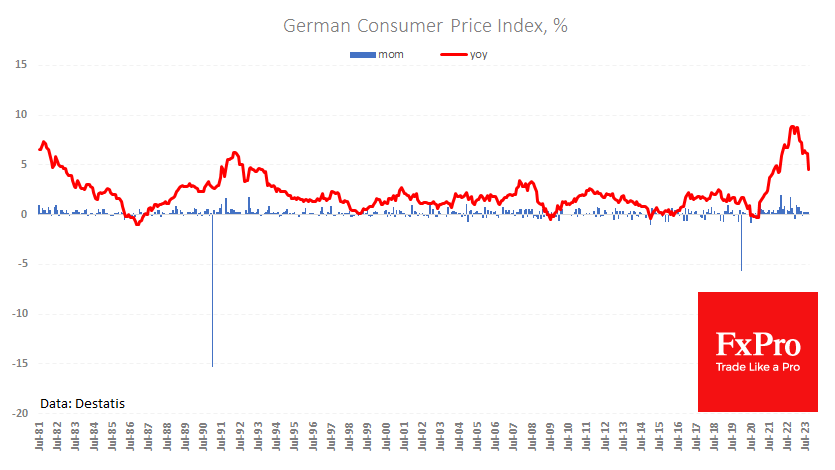

German consumer inflation slowed more than expected in September, according to Destatis’ preliminary estimate.

The price growth rate slowed to 4.5% y/y from 6.1% y/y vs. 4.6% y/y expected. However, the monthly rate growth remains elevated, with the last four months adding 0.3% each, bringing the annual rate to 3.6%.

Separately today, Spanish inflation accelerated to 3.5% from 2.6% the previous month and a low of 1.9% in June.

In general, the release of weaker-than-expected inflation and activity data adds to the pressure on the local currency, arguing for easing monetary policy.

Tomorrow’s composite data for the entire Euro-Zone is expected to reach 4.5% y/y, slowing from 5.2% in August.

On Thursday, the EURUSD had a chance to hold above the 1.05 level thanks to the US currency’s weakness against its major rivals. So far, the move looks more like profit-taking on an eleventh consecutive week of gains for the Dollar. However, without any significant change in the fundamentals (inflation trends and the Fed’s rhetoric), this could temporarily consolidate forces and liquidity before the dollar gains further momentum, threatening to push the euro below parity.

The latter will be particularly true if yields on Italian and other eurozone debt continue to rise because of the failure to control public spending and revive the economy.

The FxPro Analyst Team