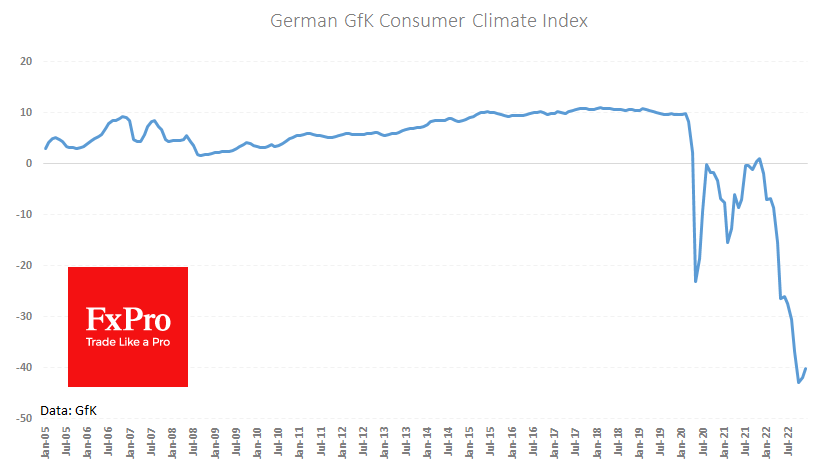

For the second month in a row, the consumer sentiment index in Germany is increasing, rising by 1.7 points to -40.2 in December. However, this strengthening slightly moved the index from the historical low of -42.8 set three months ago.

The improvement is due to a reduced propensity to save: Germans are reaching for their wallets in time for the festive season. Consumers are probably helped by lowering energy prices and news that gas storage facilities are full while the weather has been warmer than usual.

Nevertheless, the index’s recovery is considerably less brisk than during the two waves of lockdowns in Europe. Thus, Germany will not be able to rely on domestic demand to pull the country out of the crisis. So, there are higher chances that industry and the export sector will heal the economy first.

The FxPro Analyst Team