U.S. markets are closed for Thanksgiving today, and not much data has been published. Among the important data is the publication of the German consumer climate index from GfK, which fell by December to -6.7 vs -3.2 a month earlier and expectations of a decline to -4.9.

A sharp deterioration in consumer confidence was a new obstacle for EURUSD growth, leaving it at 12-week highs and then returning below 1.19.

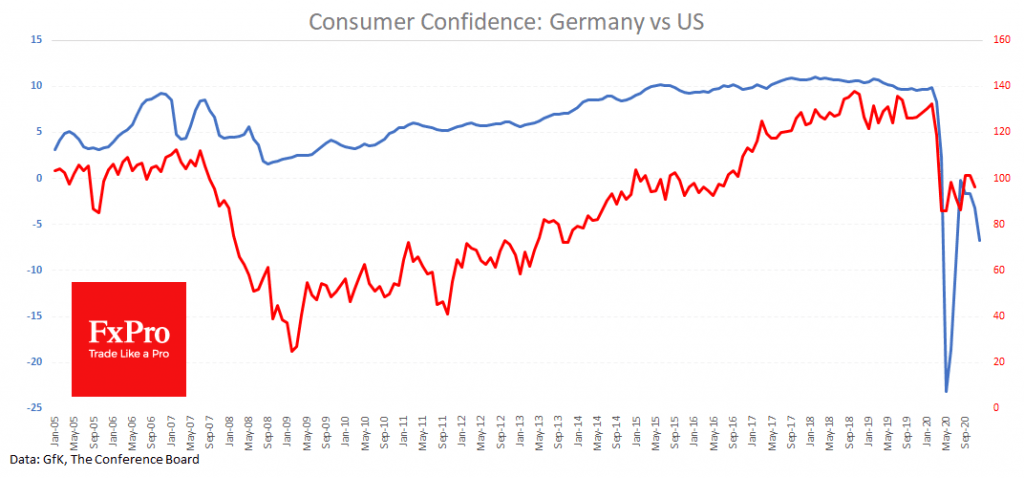

The new partial lockdown significantly dampens consumer sentiment in Germany. The graph clearly shows how negatively coronavirus restrictions have affected consumer confidence. By a wide margin, the index was not so low during the global financial crisis and its aftermath, when the German economy lost 8% YoY.

The drop in consumer confidence in the USA wasn’t so sharp, falling only to 5-year lows. The latest estimates, earlier in the week, showed a decline, but not as deep.

The FxPro Analyst Team