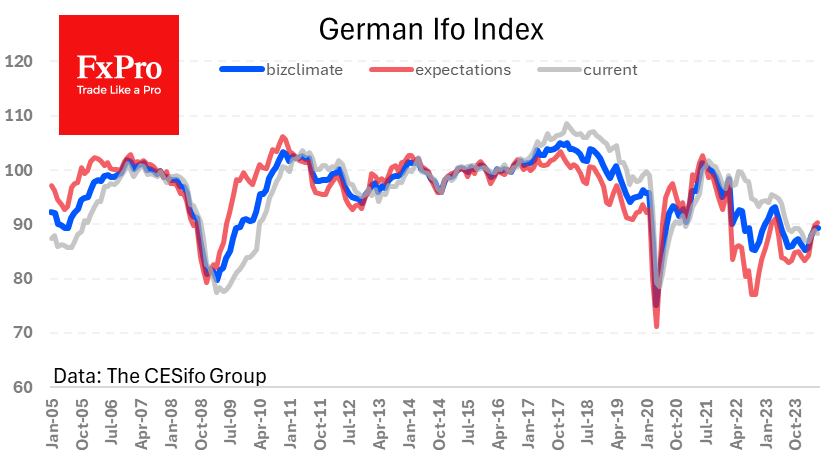

The improvement in Germany’s business climate stalled in May, according to data released by Ifo. The index remained at the same level of 89.3 as a month earlier. The indicator was last higher in May last year, but analysts, on average, were expecting a further increase to confirm the more positive PMI reading released last week.

Although markets reacted sluggishly to this publication, it probably accounts for the Euro’s weaker performance against its major peers. EURUSD has pulled back below 1.0850, while EURGBP is testing the 0.8500 mark. The latter pair has not traded persistently lower since August 2022.

The steady decline over the past two weeks is mainly due to the belief that the Bank of England will extend the pause before the rate cut cycle starts and the ECB will ease policy at its next meeting on 6 June.

If the support at 0.8500 does not hold, the nearest next support will be the area of 0.8250-0.8300, but one should be prepared that the decline will not stop there.

The FxPro Analyst Team