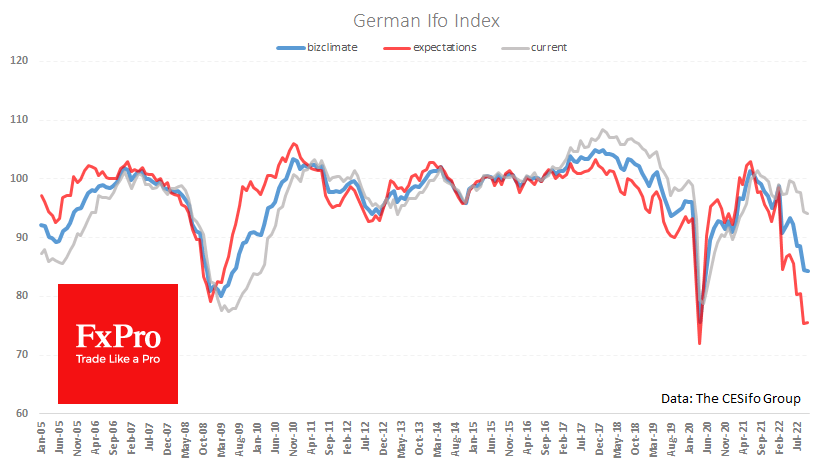

The Ifo Business Climate Index from Germany was above expectations in October – slightly down from 84.4 a month earlier to 84.3. The index components’ current situation and business expectations also marginally changed. But the overall level shows that the climate remains gloomy.

The expectations index rose from 75.3 to 75.6 for the month, while the assessment of current conditions fell 0.4 points to 94.1.

Economists are watching the business expectations component most closely as its sharp rise from the lows of the previous crises (2009 and 2020) signalled the start of a recovery in the German economy.

For traders on the foreign exchange and stock markets, the substantial rise of this index signalled the start of a rally in EURUSD and euro-region equities. Thus, supported by a strongly rising index in May 2020, EURUSD began its 10% rally in the following two months, pushing sentiment sideways. The index had previously reached its low point in December 2008, but only a powerful jump in March 2009 coincided with a general reversal of the markets and a subsequent 8-month rise in the pair of around 20%.

Today’s publication did not provide a meaningful signal of improvement in the German economy, so it is unlikely that the release is slightly better than expected. Traders will take the stoppage of the decline as a signal that the German economy has passed its low point.

The FxPro Analyst Team