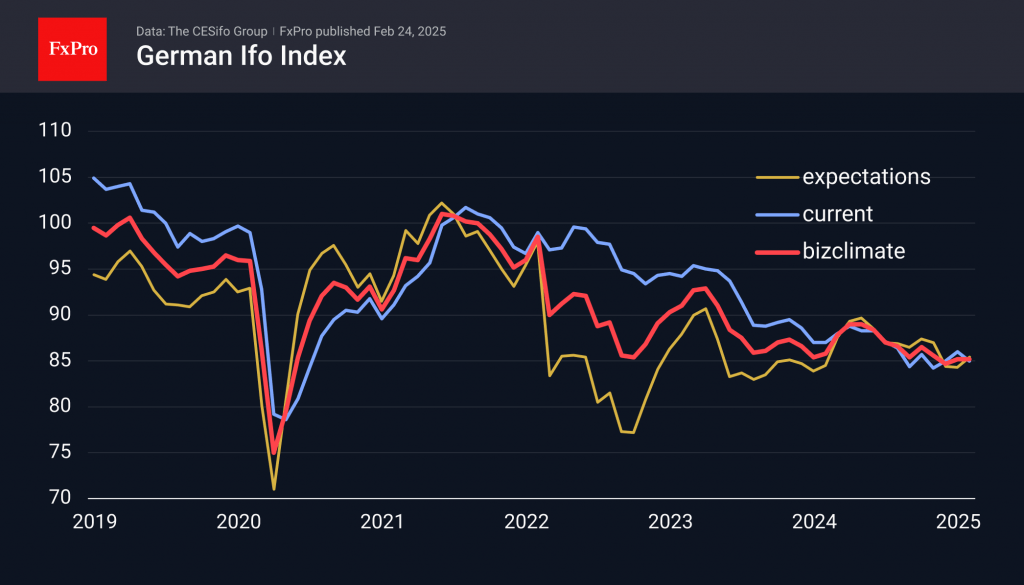

According to the latest Ifo report, the German business climate remained unchanged in February. The business climate index stayed at 85.2, with a deterioration in the assessment of the current situation offset by an increase in the expectations component. It is also noted that for almost a year, the index components have nearly converged into a single line, with all three slowly declining.

On average, market analysts anticipated positive development, so the outcome led to some pressure on the single currency, which fell below $1.05. Over the weekend, Germany’s parliamentary elections largely aligned with expectations, confirming the transition of power from Scholz to Merz. The latter announced a course of “independence from the US.”

The far-right AfD party came in second with 21% of the vote, but other parties declined to form a coalition with it, thus significantly reducing its influence. Markets reacted moderately positively to the election results, with EURUSD and the German DAX40 opening the day higher. However, a more cautious reading on business sentiment limited these gains.

From a technical perspective, the EURUSD continues to encounter significant resistance at 1.05. A break below this level at the end of last year indicated a market shift towards a possible decline below parity. In January and February, the euro attempted to rise above this level but has so far encountered resistance.

The FxPro Analyst Team