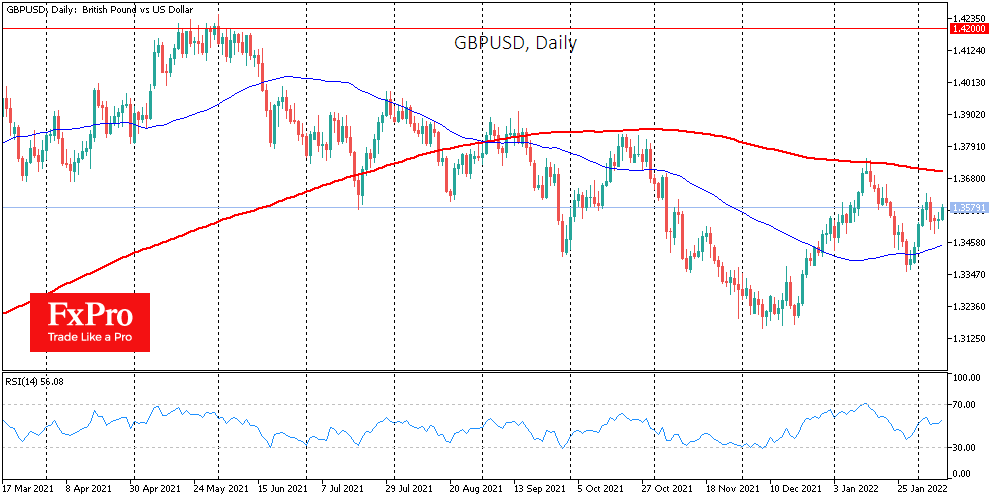

GBPUSD is gaining 0.35% on Wednesday, surpassing 1.3585, not far from the month’s highs of 1.3620. The British pound is closely correlated with equity market dynamics, and the latest upward momentum in major global indices supports GBP buyers.

Also noteworthy is that the Bank of England switched to the next gear in its monetary policy tightening as last week’s rate hike was 25 b. p. rather than 50 b. p. by only a slight margin.

The euro is also losing ground against the pound after a sharp spike at the ECB meeting. In our view, the EURGBP surge was caused by a technical bounce on touching the 6-year low area. Meanwhile, the Bank of England’s stance suggests a much more decisive rate hike, which should provide a carry trade inflow into the pound and further push up the British currency.

With the continued upward trajectory of equity indices, a renewal of the 6-year highs of the pound to the euro and a test of the 1.3750 area should come in just a matter of weeks.

The FxPro Analyst Team