The British Pound is losing ground for the 6th consecutive session, falling 2.2% to 1.2850. The downward movement began as a correction after a 9-sessions rally from 30 June but accelerated following the release of weak inflation data earlier in the week.

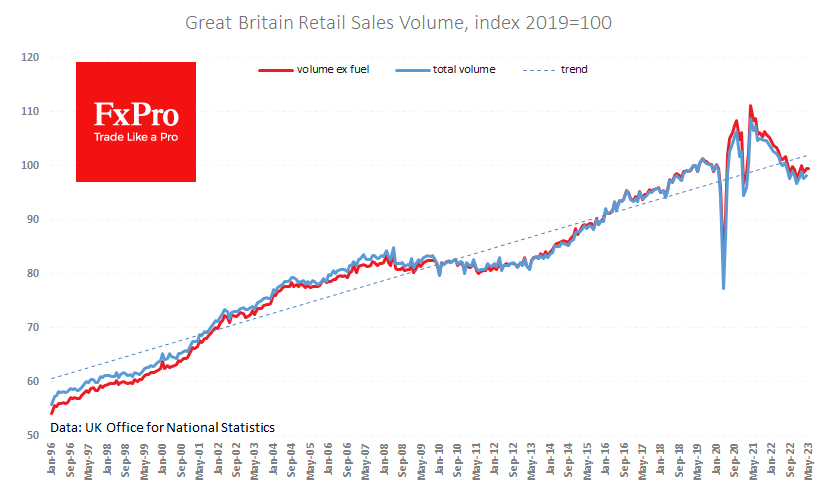

Strong retail sales figures failed to reverse the GBPUSD’s downward trend on Friday. The data, released before the London session, showed that total sales rose 0.7% in the month (+0.2% expected), marking the third consecutive month of growth. In the same month last year, the decline had narrowed to 1% from a peak of 6.7% in December.

So far, however, we can only confidently talk about the end of the recession, not the emergence of sustainable positive momentum. The volume index for retail sales is now roughly at the level of October and August last year and is 2.3% above the lows. And with the five-year period after 2008, the UK knows how difficult the road to full recovery can be. Moreover, back then, the economy was supported by loose monetary conditions. And the current level of sales is locked in with relatively high employment and tight monetary policy.

And that’s not good for Sterling. The big question now is how low it will go. GBPUSD has been trading in a fairly narrow uptrend since March. And all this fits into a broader trend of the pair’s recovery from multi-year lows last September.

The lower boundary of this uptrend is now at 1.2750, 0.6% lower at the time of writing. A break below this level would be the first sign of a break in the recent trend and final confirmation would come from a drop to 1.2650 with a test of the 50-day moving average and entry into the levels where the pair has reversed several times.

The GBPUSD corrective pullback may not stop at these levels, and we will see a decline to 1.23 by the end of September and 1.2070-1.2100 in the next few quarters. Reaching these levels will require a reassessment of the Bank of England’s monetary policy outlook. The inflation report has dramatically reduced the chances of a 50-point rate hike in two weeks’ time. However, it is also likely that markets will revise their expectations for a top rate of 6.00%, moving closer to the economists’ average expectation of a top rate of 5.5%.

The FxPro Analyst Team