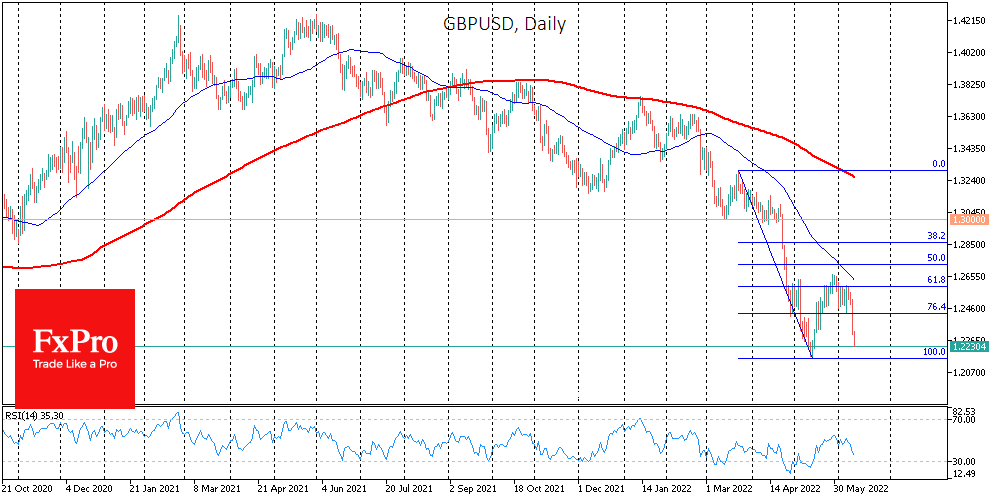

GBPUSD is trading near 1.2250, losing about 3% in the last four trading sessions. Pressure on the pound intensified on Monday, releasing a disappointing set of statistics. Monthly estimates showed the economy shrinking by 0.3% for April, contrary to expectations of a 0.1% growth. Industrial production data also fell short of expectations.

High employment levels do not promise a rapid expansion in the current environment. As we can see, manufacturers generally prefer to take a wait-and-see attitude, maintaining a 0.7% y/y gain.

For the UK economy, it will get worse before it gets better. And it is not very good news for the GBPUSD. Sterling is approaching the lows of mid-May. A move below 1.2150 would confirm that we have only seen a rebound in the bear market at the end of last month, and we shouldn’t be surprised by an intensified sell-off and possible failure with a potential target at 1.1500 (March 2020 lows and 161.8% of the March-May 2022 anti-rally).

The FTSE100 has fallen sharply below its 200-day moving average due to pressure on global markets. This dip attracted buyers in March and May as volatility began to subside. The 7700 level from 2018 remains too attractive for long-term sellers. In February 2020 and two years later, we saw a furious sell-off as powerful fundamentals were on the bears’ side, as they are now. Correction targets for the FTSE100 could be levels of 7000 for a relatively soft landing and 6800 for a deeper correction.

The FxPro Analyst Team