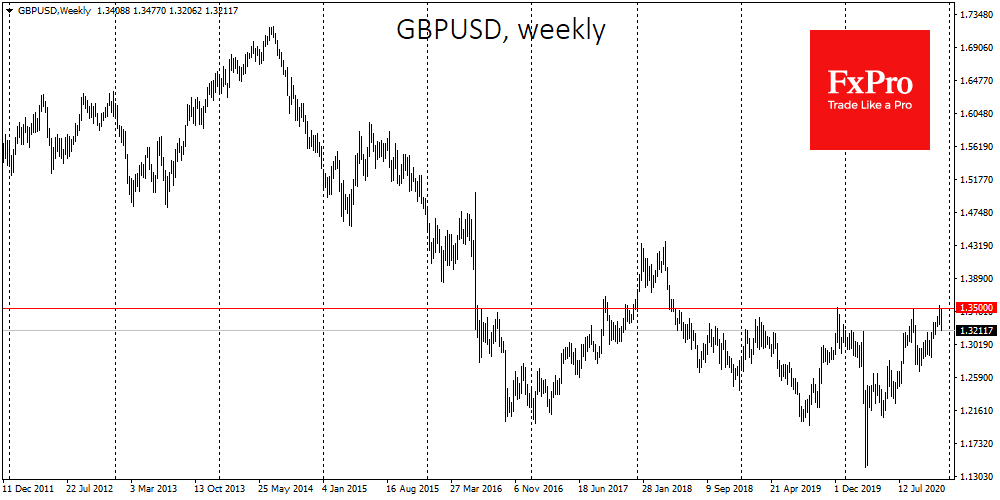

The US dollar is declining for the second day in a row. The decline received a new boost after disappointing weekly labour market data. However, the Pound was even weaker than the dollar amid tough trade talks with the EU. GBPUSD stalled again near 1.35.

British Prime Minister Johnson on Thursday noted the ‘strong possibility’ that there will be no trade deal with the EU because of serious disagreements over fishing rights, economic fair play and dispute settlement. If there is no deal, then the trillion-dollar trade turnover between the EU and Britain could switch to WTO rules, meaning it would be subject to much higher duties, which promises to dramatically reduce mutual trade and hurt firms’ profits on both sides of the negotiation table.

Exiting without a deal could be a severe blow to the British Pound. Over the past two and a half years, GBPUSD has reversed downwards five times from the area near 1.35. The reversal in August this year was the least profound, sending the pair into the 1.27 area vs the average 1.23.

Dollar weakness is now working on the side of the Pound, cushioning its decline. So even if talks fail, buyers could come to the rescue well above the 1.20 area.

But there are many more questions about how the Pound will behave against the Euro. EURGBP in a sharp move yesterday came out of the area below 0.9000 and climbed to 0.9130, the area of the extremes of the last four years. The pair is being pushed up by Britain’s problems with an orderly exit from the EU, but a chaotic Brexit hurts Europe as well, so at some point, the prospect of a no-deal exit will apply pressure to the Euro as well.

It will be interesting to see how it all plays out. The Euro has managed to enter a new, higher trading range against the dollar. This raises the chances that the single currency will tend to move higher against the Pound as well, turning the current resistance above 0.9100 into future support, targeting the area of the historical highs at 0.9500.

The FxPro Analyst Team