New York traded Natural gas is up 3% on Monday, having managed to break away from support again. Gas has formed an uptrend from the April lows but has not yet switched to an acceleration phase.

Gas prices formed a low in April just above $2 before starting an uptrend, and prices are now 34% above those lows at $2.75. This is a smooth rise, given that US gas prices peaked at almost $10 a year ago, nearly four times higher.

This price action looks like a textbook accumulation phase after a capitulation. However, optimists should be aware that such inattention to the rise in gas prices can last long.

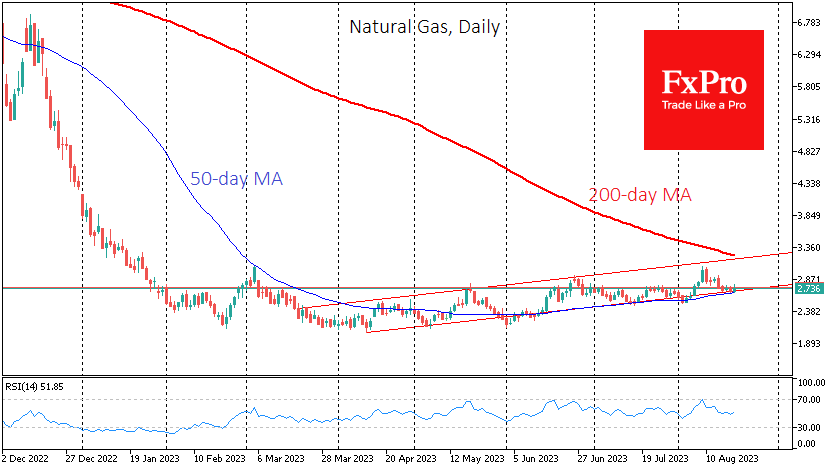

The uptrend channel originated from the April lows and, since July, has repeatedly acted as a support from which gas buying has intensified. There were attempts to break this trend on Friday and earlier in August, but gas confidently returned to the corridor.

This lower boundary of the channel almost coincided with the 50-day moving average, which has also repeatedly tested its strength since June. It has been pointing up since the beginning of the summer, giving the bulls an additional argument.

Having managed to hold the channel’s lower boundary, Natural Gas appears to be heading for its upper boundary, above $3.16. The 200-day moving average is slightly higher at $3.23.

The ability of gas to consolidate above its 200-day moving average will attract our attention, as it could herald a more active bullish phase in the market, potentially opening a quick path to $4.0 or even $5.5.

Locally, a “strategy” works against this scenario on the higher – weekly – timeframes where the 50-week moving average has dropped below the 200-week moving average. This formation is called a “death cross” and gives clear signals in the commodity markets at the current timeframes. However, we believe that the gas capitulation has already occurred between November last year and February this year.

The FxPro Analyst Team