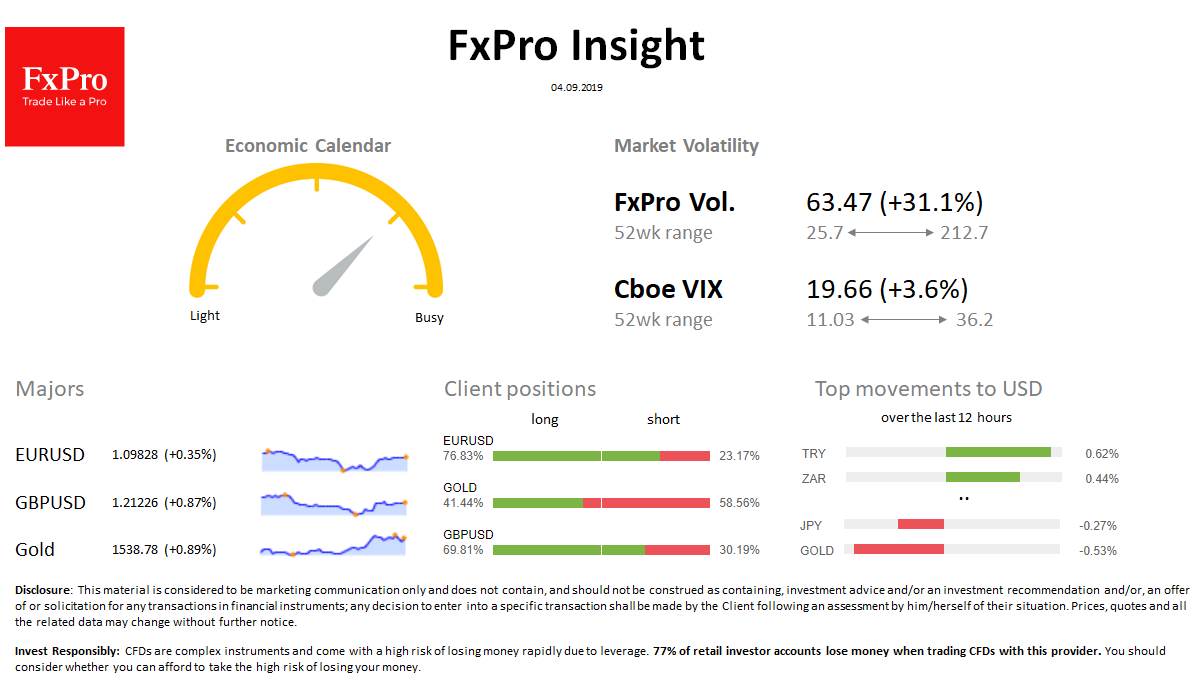

FX: The dollar index retreated from the two-year highs at 99.30 on the alarming data, falling 0.5% from Tuesday’s highs. EURUSD rose to 1.0980. GBPUSD bounces after a drop to 1.1960, reaching 1.2130. Currency market volatility is increasing.

Stocks: S&P 500 futures are gaining support, adding 0.9% from the start of the day. Hong Kong’s market index jumped 3.7%, Shanghai’s blue chips are up 1% on a strong report on service activity. The VIX volatility index has grown from 18.98 to 19.66.

Commodities: Brent price almost not changed over the last 24 hours, remaining at $ 58.30. Gold rolled back to $1537 after another failed attempt to climb above $1550.

Crypto: Bitcoin remains at $ 10,500, losing the growth momentum but avoiding decline. Top-10 altcoins price changes vary in the range from -2.5% to + 1.2% over the past 24 hours.

Important upcoming events (GMT):

08:00 EUR [ !!] Euro area PMI Composite 13:15 GBP [!!!] U.K. Inflation Report Hearings 14:00 CAD [!!!] Bank of Canada Overnight Rate 17:00 USD [ !!] Fed Beige Book