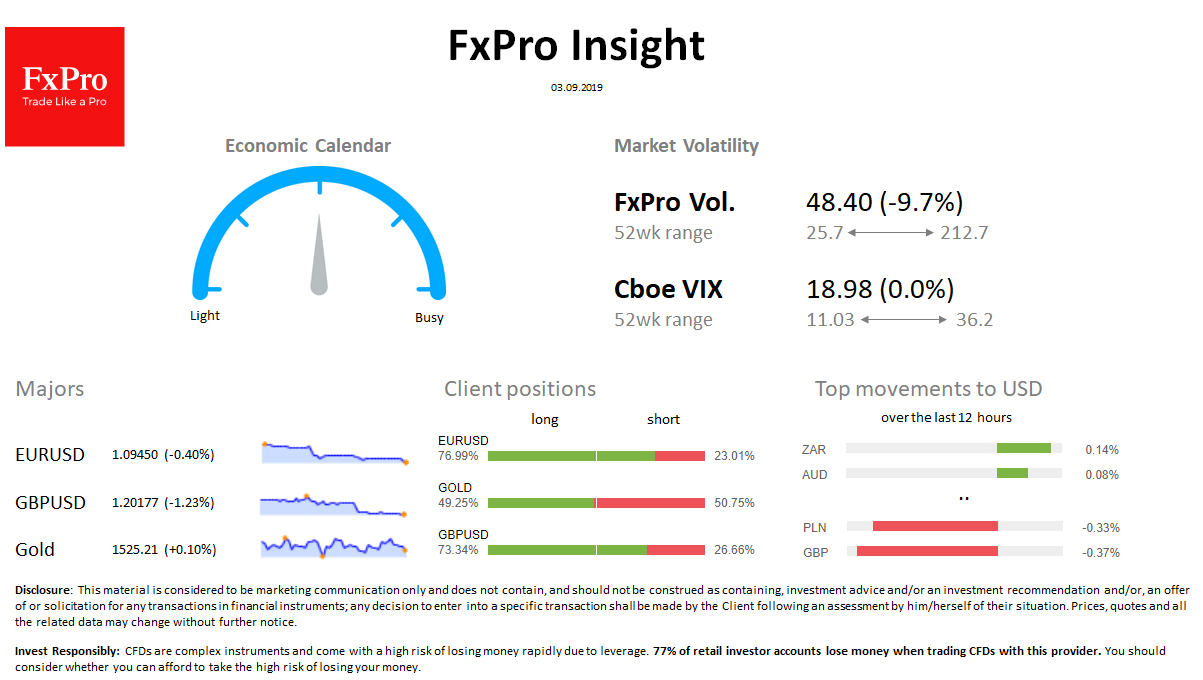

FX: The dollar index advanced for the seventh session in a row to 99.20, adding 0.3% in the morning. EURUSD fell to 1.0930. GBPUSD fell briefly below 1.20. Except for the pound, market volatility was reduced due to a holiday in the US.

Stocks: S&P 500 futures did not manage to develop a rebound, declined by 0.4% to Friday’s closing levels. Hong Kong and Shanghai indices fell slightly on Tuesday morning.

Commodities: Brent fell by 1.3% over the last 24h to $ 58.20. Gold is trading near $1527, balancing in the range of $1520-$1530 for 3rd trading session.

Crypto: Bitcoin jumped to $ 10300, reinforcing a rebound from the “bottom” at 9300. Top-10 altcoins have been added in the range from 1.5% to 5.5% over the past 24 hours.

Important upcoming events (GMT):

08:30 GBP [ !!] U.K. Construction PMI 14:00 USD [!!!] U.S. ISM Manufacturing PMI 21:00 USD [ !!] FOMC Member Eric Rosengren Speaks 01:30 AUD [!!!] Australia Gross Domestic Product