Market overview

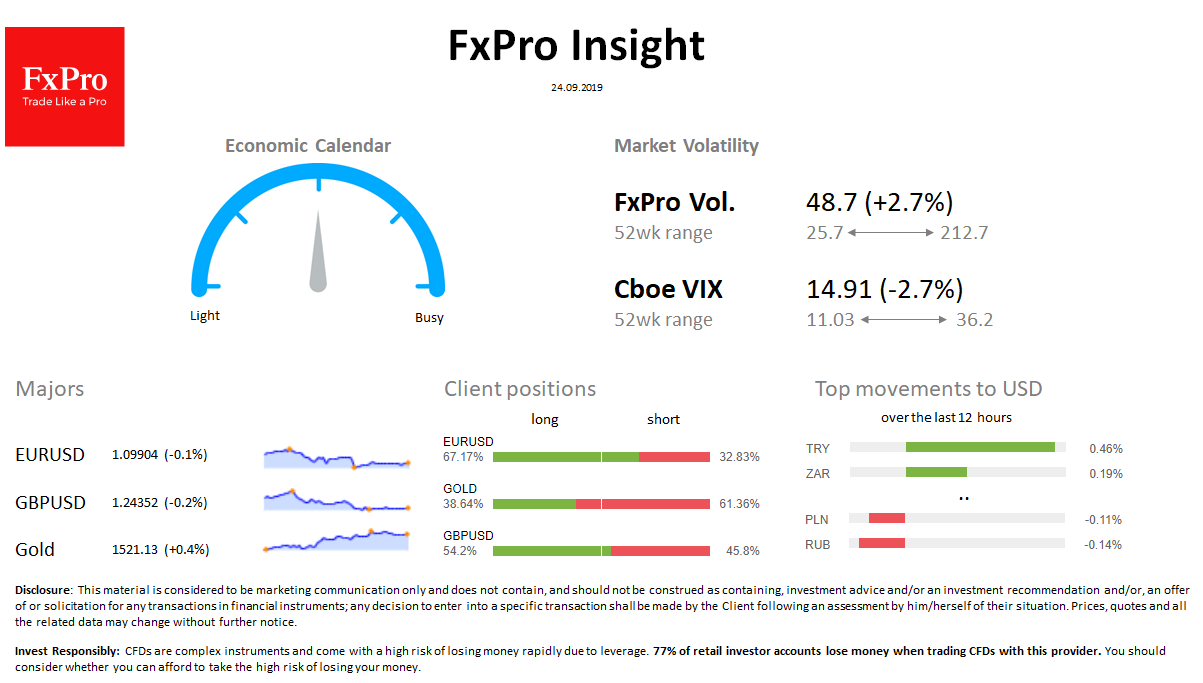

FX: The dollar index corrected from 98.4 to 98.3. EURUSD remains below 1.1000, holding levels immediately below this mark. Highly profitable TRY, ZAR add more than 0.4% to USD from the beginning of the day. NZDUSD is trying to catch on 0.6250. The volatility of the foreign exchange market increased at the beginning of the week.

Stocks: S & P500 Futures again returned to around 3000. MSCI world has not changed much since the beginning of the day. Nikkei225 won back losses Monday. The VIX volatility index fell from 15.3 to 14.9.

Commodities: Brent slid to $ 63.0 on fears of a steady global demand. Gold develops the climb, reaching $ 1,523.

Crypto: Bitcoin decreased to $ 9,700. Top 10 altcoins lose from 1% to 8% in the last 24 hours.

Important upcoming events (GMT):

08:00 EUR [!!] Germany Ifo Business Climate 09:55 AUD [!!] RBA Governor Lowe Speaks 14:00 USD [!!!] U.S. CB Consumer Confidence