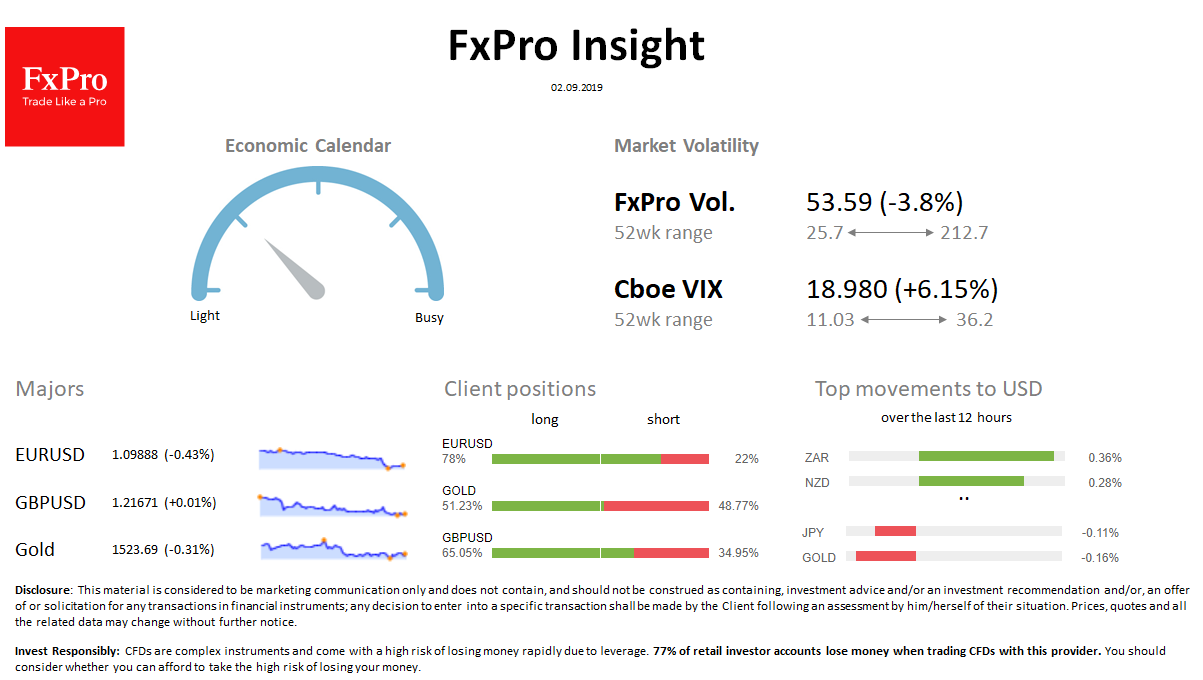

Market overview FX: The dollar index is unchanged at the beginning of the week at 98.80 after strengthening by 0.4% on Friday, updating the highs from 2017. EURUSD slid below 1.10. GBPUSD fell to 1.2170. At the same time, market volatility slightly decreased.

Stocks: S&P 500 futures opened the week with a 0.9% fall, but have already recaptured about half of the initial failure. MSCI Asia Pacific is losing 0.25%. The VIX volatility index has grown from 17.90 to 18.98.

Commodities: Brent is adding 0.2% to 58.98 after failing at 2.6% on Friday. Gold rolled back to $1523 amid rising dollar.

Crypto: Bitcoin is making growth attempts at $ 9,750, finding the bottom at 9,300 on Thursday and Friday. Top 10 altcoins vary in the range from -2.7% to + 4% over the past 24 hours.

Important upcoming events (GMT):

08:00 EUR [ !!] Euro area Manufacturing PMI 08:30 GBP [!!!] U.K. Manufacturing PMI All day U.S. Labor Day Detailed economic calendar