Market overview

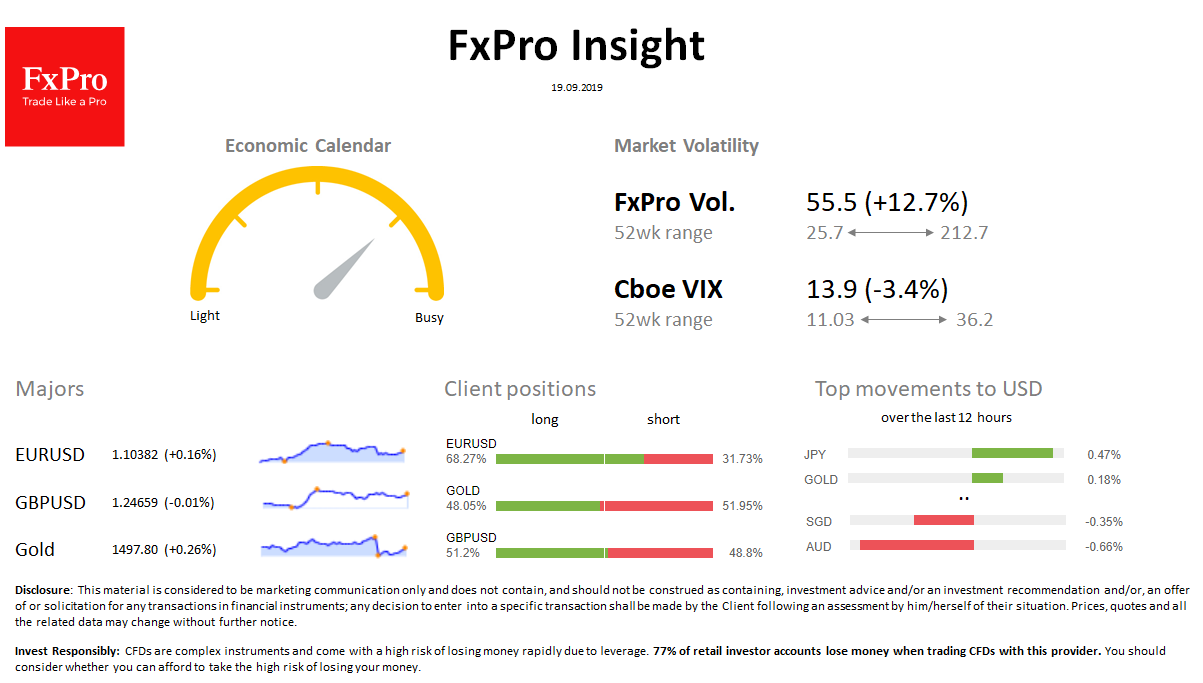

FX: The dollar index now stands at 98.0, returned more than half of the 0.4% gain after the Fed’s comments. EURUSD remains at 1.1050; AUD and CNH continue to weaken; JPY is adding to the dollar. Currency market volatility remained below average monthly levels.

Stocks: S&P500 Futures remain close to 3000. Chinese indices returned their initial gain at the opening of the day; Nikkei225 weakened in response to the BoJ saved its policy. The VIX volatility index fell from 14.6 to 13.9.

Commodities: Brent fell to $63.0, calming down after the weekly start Gold declined to $1495.

Crypto: Bitcoin fell by 3.3% overnight to $9900. Top-10 altcoins lose from 2 to 6% in the last 24 hours.

Important upcoming events (GMT): 07:30 CHF [!!!] SNB Policy Rate 08:30 GBP [!!!] U.K. Retail Sales 11:00 GBP [!!!] Bank of England Interest Rate Decision 14:00 USD [ !!] U.S. Existing Home Sales