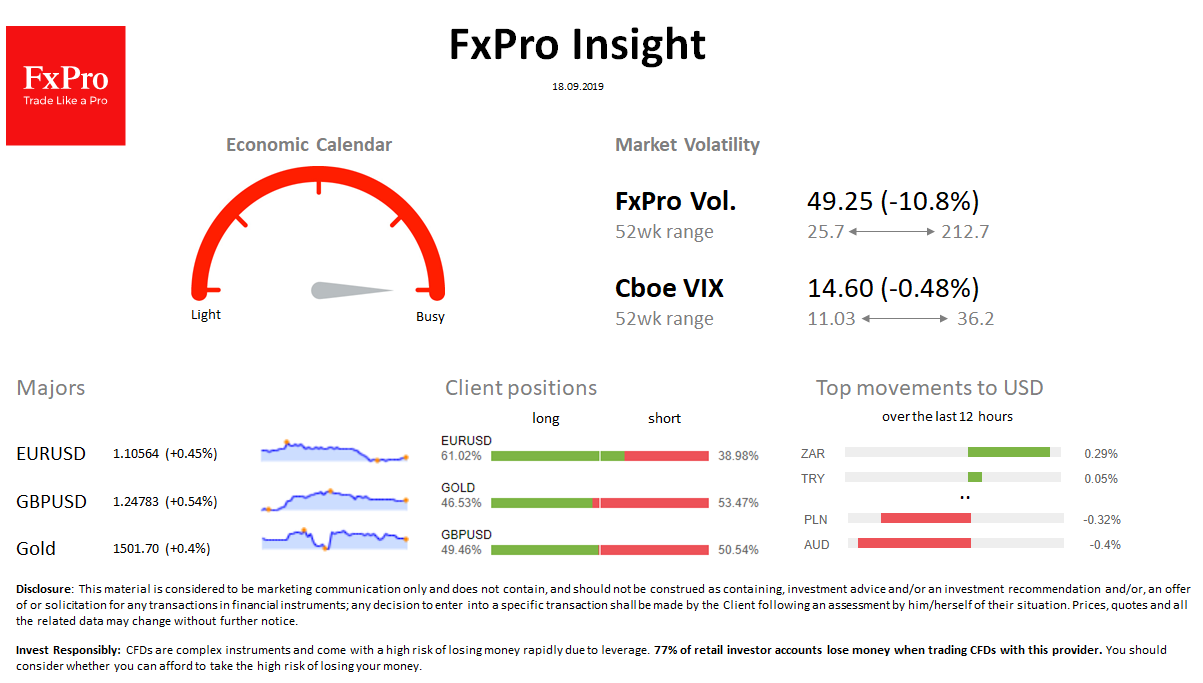

Market overview FX: The dollar index added 0.2% on Wednesday morning to 98.0 after 0.4% decline the day before. EURUSD has returned to 1.1500. Yielding currencies (ZAR, TRY, RUB) strengthen against the dollar, while AUD, NZD, CHF declined. The volatility of the foreign exchange market decreased in anticipation of decisions on the rates of the Fed, the Bank of Japan.

Stocks: Futures for S&P500 are trading near the 3000 level, near closing levels on Friday. Chinese indices added 0.7%, partially recovering after two days of decline. The VIX volatility index is almost unchanged from 14.7 to 14.6.

Commodities: Brent fell to $ 63.5 (-5% overnight, but + 6.8% for the week) on reports of a quick recovery in production in Saudi Arabia. Gold continues its treading around $ 1,500.

Crypto: Bitcoin is trading at $ 10,100, having changed little again in a day. The top 10 altcoins, by contrast, have added between 1.5% and 16% in the last 24 hours.

Important upcoming events (GMT):

08:30 GBP [!!!] U.K. Consumer Price Index 12:30 CAD [!!!] Canada Consumer Price Index 18:00 USD [!!!] FOMC Rate Decision 18:30 USD [!!!] FOMC Press Conference Detailed economic calendar