Market overview

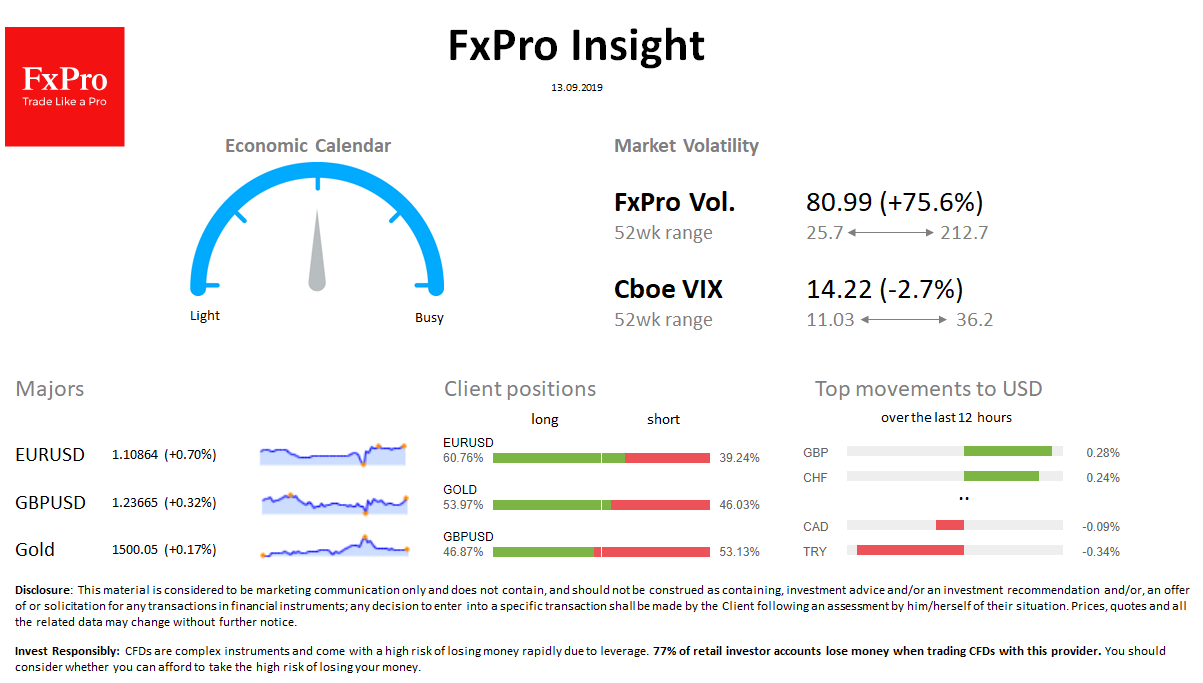

FX: The dollar index lost 0.5% to 98.10, mainly due to a weakening against the EUR. EURUSD jumped to 1.1100 after a short-term decline to 1.0930 yesterday. European GBP, CHF, EUR are the leaders in growth. TRY is corrected after the jump the day before, commodity CAD, NOK are losing ground. The volatility of the foreign exchange market jumped sharply yesterday after the decision of the ECB.

Stocks: S&P500 Futures are up 0.3% since the start of the day after rising 0.2% on Thursday, Japan’s Nikkei225 rallies 10th day in a row, peaking since May. The VIX volatility index fell from 14.6 to 14.2.

Commodities: Brent is trading below $60, having managed to recover some losses after the drop to 58.40. Gold is at $ 1,500, despite a rebound from $1524 on Thursday.

Crypto: Bitcoin is trading near $10,300. The top 10 altcoins price changed from -3% to 2% in the last 24 hours.

Important upcoming events (GMT): 09:00 EUR [!! ] Euro area Trade Balance 12:30 USD [!!!] U.S. Retail Sales 14:00 USD [!! ] U.S. UoM Consumer Sentiment