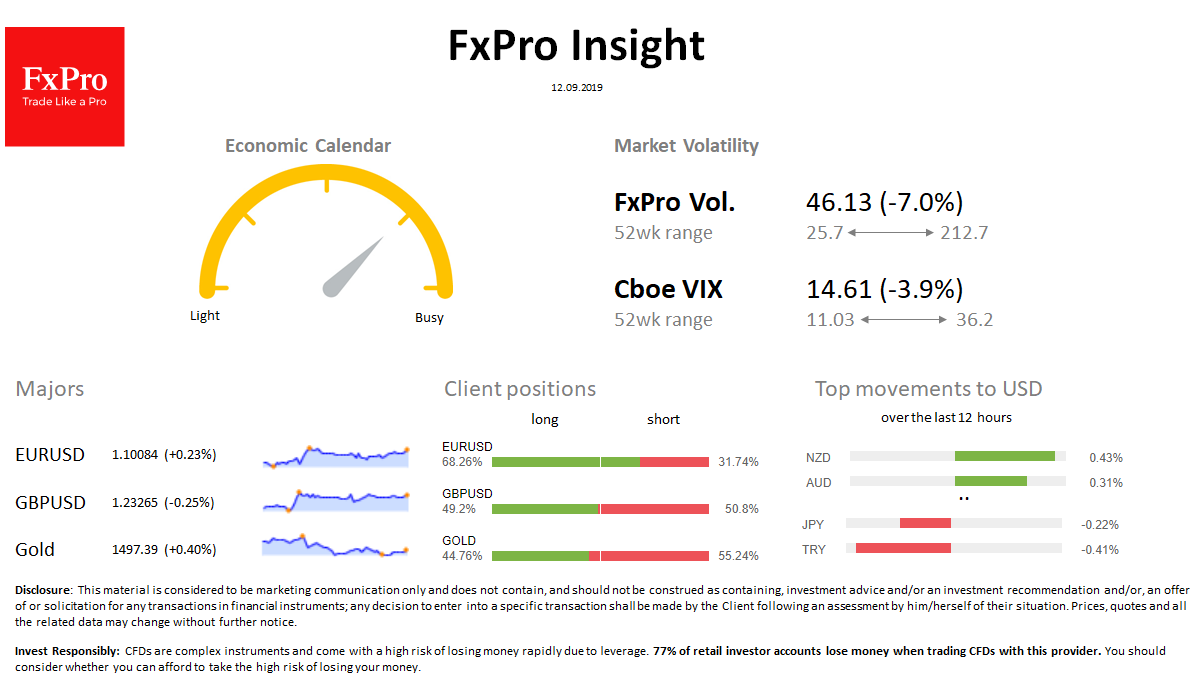

Market overview FX: The dollar index added 0.3% to 98.60, despite Trump’s comments to lower the rate. EURUSD returned to 1.1000 after falling from 1.1050 to 1.0980 yesterday. AUD and NZD are the leaders in growth, developing a rebound, while JPY remains under pressure, reflecting an increase in demand for risky assets. Foreign exchange market volatility is declining.

Stocks: S&P 500 futures are up 0.2% since the start of the day after the 0.7% growth on Wednesday. Japanese Nikkei225 rallies 9th day in a row, added 6.6% this month. The VIX volatility index fell from 15.3 to 14.6.

Commodities: Brent fell to $ 60.4, developing a pullback from monthly highs above $ 63.2. Gold has returned to an area above $ 1,500.

Crypto: Bitcoin is trading near $ 10K. Top 10 altcoins vary from -7% to 2% in the last 24 hours.

Important upcoming events (GMT):

11:45 EUR [!!!] ECB Interest Rate Decision 12:30 EUR [!!!] ECB Press Conference 12:30 USD [!!!] U.S. Consumer Price Index