Market overview

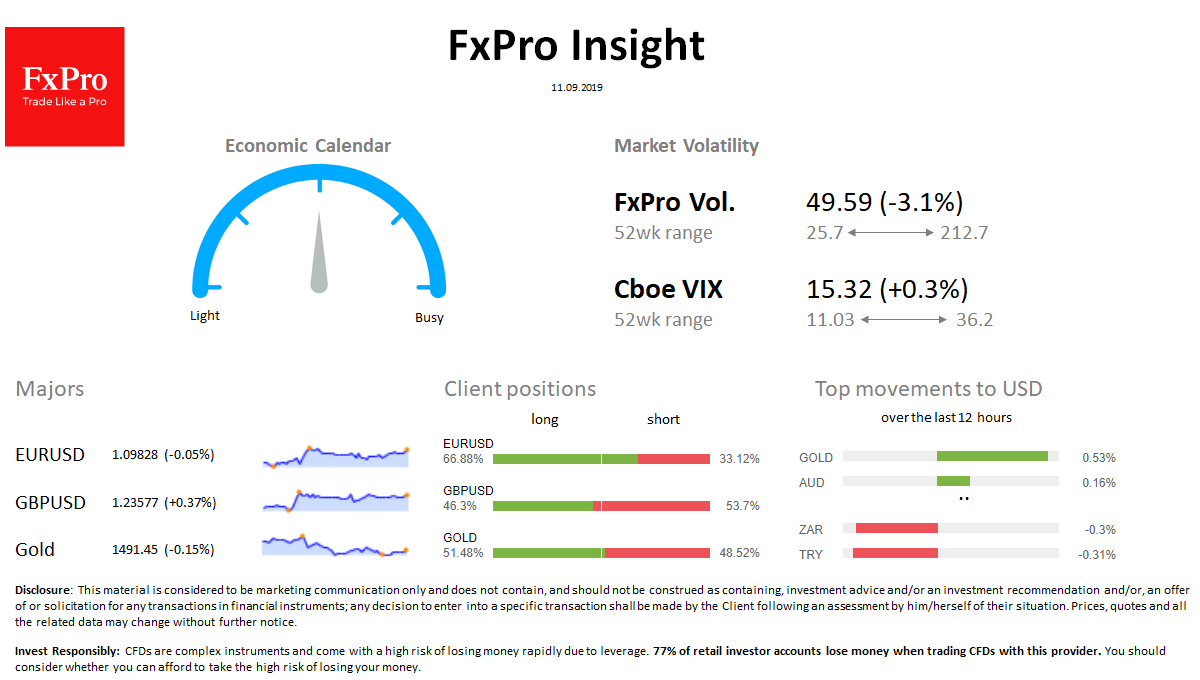

FX: The dollar index remains in a narrow range of around 98.30 for the fifth trading session in a row. EURUSD treads around 1.1030. AUD and CNH added while JPY is declined, reflecting an increase in demand for risky assets. Overall forex market volatility declining.

Stocks: S&P 500 Futures are up 0.2% before the European trading starts. Japanese Nikkei225 grew 0.6% on Wednesday, bringing growth from the beginning of the month to 5.6%. The VIX volatility index grew from 15.2 to 15.3.

Commodities: Brent recovered to $62.3 after a 2% drop to $61.7. Gold suspended the decline, stabilizing after falling below $1,490.

Crypto: Bitcoin has been trading near $10K, declined over the past week. Top-10 altcoins lose from 0.5% to 4.5% in the last 24 hours.

Important upcoming events (GMT): 12:30 USD [!!] U.S. Producer Price Index 14:30 WTI [!!] U.S. Crude Oil Inventories